Why The Fed’s Inflation Battle Has Just Begun

Yes, inflation is taking it toll on the ballyhooed consumer. The figures for retail and food service sales released this AM for April left nothing to the imagination, falling by nearly 3% in inflation-adjusted terms from the level of April 2021. Two years of spending contraction hardly amounts to evidence of a “strong” consumer.

Of course, the latter figure is not much of a benchmark, either, since it reflected the tail-end of 12 continuous months of madcap Covid stimmies. The latter pumped upwards of $4 trillion into household bank accounts via—-

Washington’s $930 billion of stimmy checks for 90% of the public;

$900 billion of generous benefit toppers of $600 per week and other UI coverages;

$800 billion of so-called PPP checks to small businesses and boot-strapping entrepreneurs;

hundreds of billions of forced savings owing to the government ordered closure of bars, restaurants, gyms, movies, sports arenas, malls etc

additional hundreds of billions of relief from contractual loan and rent payments enabled by the government ordered moratoriums.

Owing to this tsunami of cash, of course, the April 2021 retail spending level was something to behold, even when you wring-out the inflation. Real retail and food service sales that month were up by a stunning 46% from the previous April! There is nothing remotely like it as far back as retail sales were collected.

At the same time, the Lockdown bottom of April 2020 was one of a kind as well, reflecting a 21% decline from the pre-Covid level posted just two months earlier in February 2020. By way of comparison, the real retail sales drop during the Great Recession was just 13.5%.

That’s right. The retail sector has been whipsawed in a manner that is literally off the charts of history, meaning that all the usual trend lines embedded in the historic data have been thrown into a cocked-hat. So it is more than a fair bet that normal month-to-month incremental gains are highly unlikely to occur after three years of violent turmoil in the base.

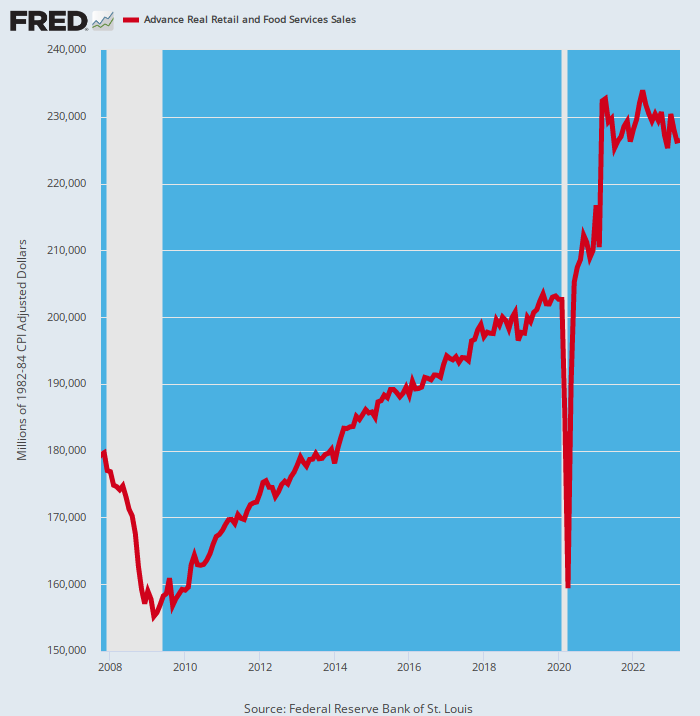

Inflation-Adjusted Retail Sales, 2007 to 2023

For want of doubt it is useful to examine the period between the pre-crisis peak in November 2007 and the February 2020 pre-Covid top. The trend line between those two points as depicted above is pretty continuous and smooth, and computes to a 1.0% per annum gain over the 12 year period.

Had that continued through April 2023, real monthly retail sales would have posted yesterday at $209.2 billion. Sales for the month were actually 8.3% higher at $226.4 billion, meaning that the pancaking pattern since April 2021 is likely just getting started.

In a word, the consumers’ dresser drawers, pantries, garages, cellars and rented storage facilities got overly stuffed with inventories during the goods buying sprees of the Lockdown and stimmy period, but are now being slowly drawn down and normalized.

As it happens, however, the retail sales and GDP numbers do not incorporate inventory gains and drawdowns at the end use/consumer level. These fluctuations are ordinarily not that important and show up as tiny wiggles in the the ebb and flow of the monthly sales rate.

Not this time, however. The good folks in Washington and their henchmen at the Fed unleashed what amount to small economic earthquakes beneath the foundation of consumer spending. That’s why consumer stalwarts like Home Depot are now surprising to the downside after several years of over-performance.

Thus, yesterday Home Depot reported its biggest revenue miss in more than 20 years and slashed its outlook for the year, reflecting the fact that households are delaying large projects and buying fewer big-ticket items like patio sets and grills. This is but the latest sign that consumers have maxed out their credit cards after splurging on Weber grills, hot tubs, and patio sets during the pandemic years.

Indeed, the yo-yoing shown above for overall retail sales was also evident in the quarterly pattern for the Home Depot behemoth which has annual sales of $158 billion per year. Accordingly, the company’s sales growth pattern was as follows at annualized rates:

Annualized Nominal Sales Change:

January 2016 to January 2020: +5.3%;

January 2020 to April 2021: +35.0%;

April 2021 to April 2023:-0.33%

Actually, during the April quarters comp store sales fell by -4.5%, wiping out all the gains since the stimmies ended in April 2021. And when those nominal sales figures are adjusted for inflation, Home Depot’s real sales have actually shrunk nearly 12% since the stimmy peak two year ago.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.