Why The Fed Is Impaled Upon Its Own 2.00% Petard

When it comes to Keynesian central banking it might well be said that if you paint by the numbers you are stuck with the brush. That is to say, the Fed has turned its 2.00% target into a economic holy grail and therefore does not dare risk a rebound of the 40-year high inflationary pressures that remain directly in the rearview mirror.

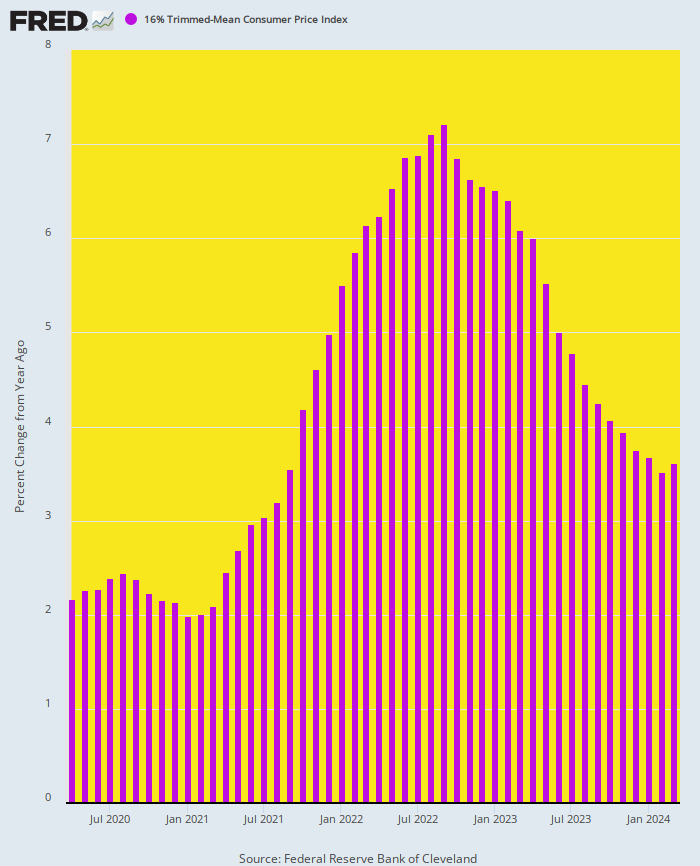

Yes, the inflation gauges have cooled considerably since the 9% CPI peak of June 2022, but the Fed is not yet remotely out of the woods. In fact, when the inflation tide is viewed through the more stable and reliable lens of the 16% trimmed mean CPI, which peaked at a somewhat lower 7.2% level in 2022, the Y/Y gain at 3.6% in March was actually up from February and was still barely halfway back to the sacrosanct 2.00% goal.

Indeed, the annualized six-month rate of change in the trimmed mean CPI has rebounded to 3.8%, while in March the three-month annualized gain posted at 4.4%. That is, inflationary pressures may well be re-accelerating.

So, as much as the boys and girls on Wall Street insist on getting their juice, the paint-by-the-numbers crowd in the Eccles Building is not nearly there yet. Not by a long shot.

Y/Y Change In the 16% Trimmed Mean CPI, April 2020 to March 2024

For avoidance of doubt, just recall the horrific charts of 1967 to 1982. Back then the good folks in charge of the Fed were not even explicitly in the Greenspanian monetary central planning business, but still had to generate four recessions during that span in order to get the inflation genie back in the jar.

To be sure, the twenty-something traders on Wall Street, who are braying ever more insistently for initiation of the next rate cut cycle, undoubtedly confuse the 1970s with the 1790s. It’s all an ancient blur in their minds, apparently.

The graybeards working toward their pensions in the Eccles Building, however, are not quite so insouciant. They recall the triple peak of inflation from that era, and undoubtedly still have the chart on their dashboards. The thundering central bank failure implicit in three inflationary surges (red bars) and four recessionary contractions (white areas) in just over a decade nearly destroyed the Fed’s open-ended remit as the nation’s unelected monetary politburo, to say nothing of its credibility on both ends of the Acela Corridor.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.