Whistling Past The Graveyard

They are whistling past the graveyard on both ends of the Acela Corridor. That is, both the gamblers on Wall Street and the borrow and spend denizens of the beltway are desperately hoping that inflation is about ready to keel over, thereby paving the way for the Fed to “pivot” to a new round of massive easing and bond-buying.

That would be copacetic, of course, because it would allow Washington to keep kicking the fiscal can down the road without facing soaring interest charges on the nation’s staggering $31 trillion public debt, even as Wall Street could scamper into a new round of leveraged speculation on the back of carry trades funded by cheap debt.

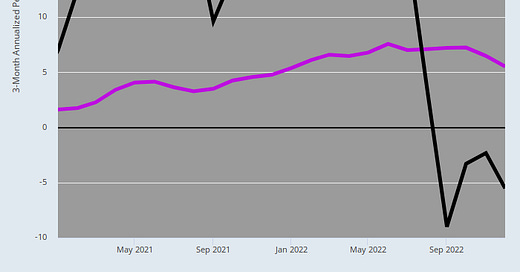

Alas, it ain’t gonna happen. The chart below tells you all you need to know. It presents on a three months rolling basis the annualized rate of gain as of December for the 70% of the CPI accounted for by “sticky” items (purple line) juxtaposed with the 30% attributable to “flexible price” components (black line).

Since this data is presented on a three-month annualized basis, it represents on a very current basis the state of play on the inflation front as of December. In this context, it is evident that the sticky price components are still rising strongly at a +5.5% annualized rate, while the one-time reversal to the downside of the “flexible price” components has now run its course.

Specifically, from the peak level in June 2022 the flexible price CPI has plunged from a +20.1% annualized rate to -5.5% in December 2022. It is that plunge in the 30% of the index heavily driven by energy prices which has caused the headline CPI to cool-down from a +9.0% peak Y/Y rate in June 2022 to +6.4% in December.

Of course, 6.4% Y/Y is still more than 3X the Fed’s target. It would also result in a 50% reduction in the purchasing power of existing savings every 10 years. So that’s not a case of inflation nearly “fixed”.

Not surprisingly, however, the graveyard whistlers on both ends of the Acela Corridor think inflation has been defeated, but only because they assume that the downward trajectory of headline inflation between June and December 2022 will continue unabated. That’s otherwise called extrapolation, not analysis.

The former doesn’t hold up. That’s because the sticky price CPI has cooled only modestly in the last six months, meaning that for the headline CPI to continue to cool rapidly, energy and other “flexible” components of the CPI must continue to head south at a goodly clip. That’s the math.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.