When you are faced with an existential threat to your very national survival, this is what you do. You mobilize your economy for all-out struggle and impose heavy-duty “War Taxes” to pay for a dramatic build-up of military capabilities.

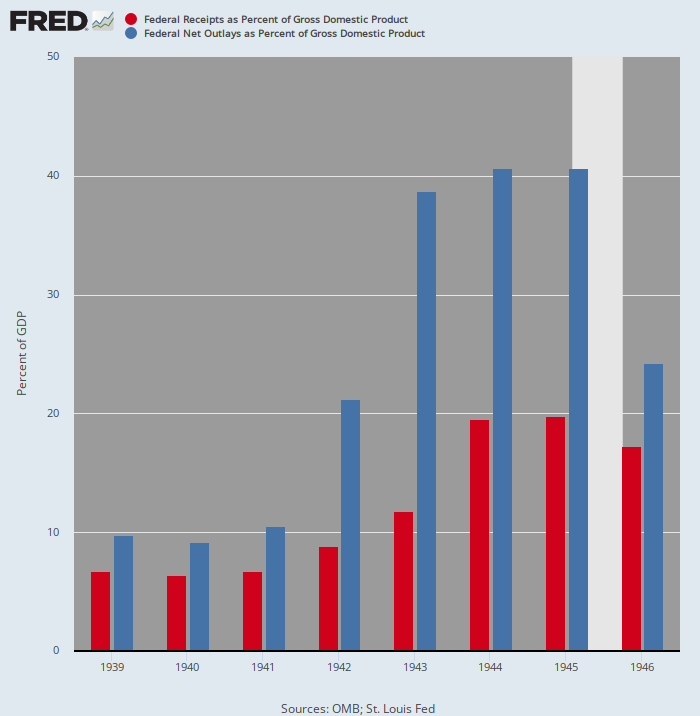

For instance, between 1939 and 1945 Federal government receipts rose nearly seven-fold—from $6 billion to $42 billion per year, owing to across-the-board tax increases that took the average income tax rate from 4% to 24% and the top rate to upwards of 90%. Relative to the national economy, Federal receipts (red bars) rose from 6% of GDP to a peak of nearly 20% in 1945.

On top of that came a huge amount of war bonds and borrowing. Accordingly, outlays from taxes and borrowing (blue bars), mostly for military mobilization, rose from less than 10% of GDP in 1940 to a war-time peak of 40% in 1944-1945.

Call that America’s national mobilization triggered by Pearl Harbor. It’s what a self-respecting democracy does when its very existence is called into question.

Surge In Federal Outlays and Receipts As % Of GDP During WWII

Alas, to a man and woman Israel’s leadership has likened the barbaric Hamas attacks of October 7th to Pearl Harbor. And Netanyahu in particular has insisted that Israel’s withering bombardment of Gaza must not give way to a “pause” or ceasefire just as Washington did not stand down after Pearl Harbor, either.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.