The UniParty Consensus—Spend, Borrow & Print—Won’t Be Broken In 2024

The deeply embedded economic policy of the UniParty boils down to “spend, borrow and print”. There are slight difference of emphasis and priorities between the Dem and GOP wings of Washington’s Infernal Inflation Machine, but it all ends up in the same place.

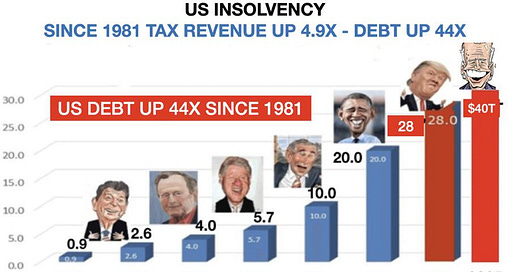

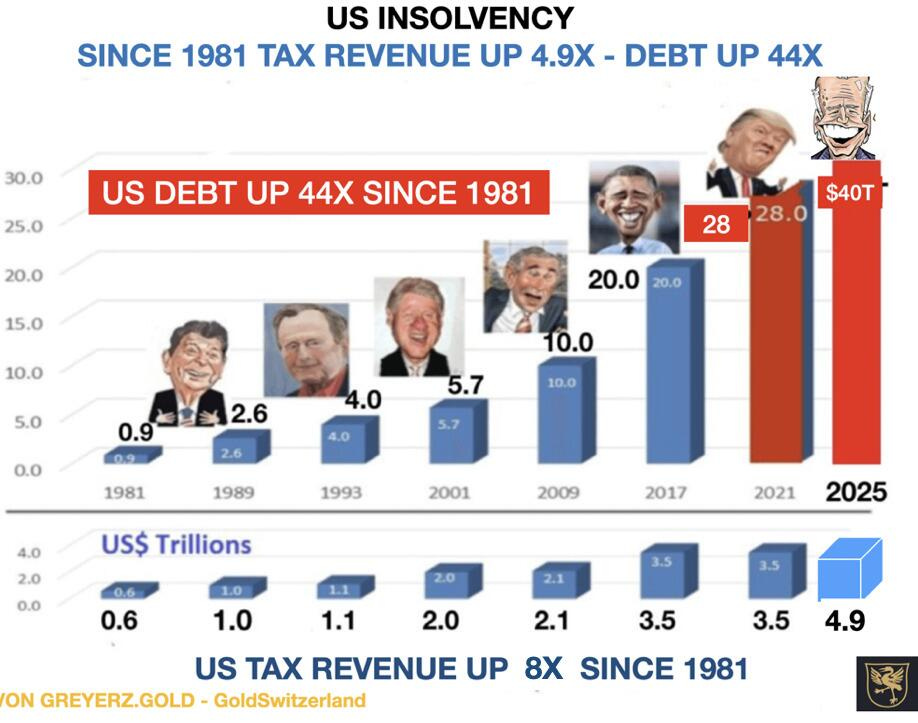

For want of doubt, consider the graphic below. Since the Gipper rode into Washington in January 1981 vowing to tame the nation’s dangerously rising public debt, Uncle Sam’s IOU mountain has risen from $900 billion to $36 trillion. That a nice round 40X gain in slightly more than 40 years.

Needless to say, neither the GDP nor Federal revenues have remotely kept up. GDP has risen by just 9.5X and Federal revenue is up from about $600 billion to $4.9 trillion in FY 2024.

That’s a mere 8X gain, meaning that when your debt is growing five times faster than your revenue, a day of fiscal reckoning will indeed come. That was hinted at in the fiscal year just ended, when interest payments crossed the trillion-dollar barrier for the first time, clocking in at $1.13 trillion or 23% of total revenue collections.

So with debt levels and interest payments in a self-fueling spiral, the impending fiscal conflagration will likely materialize sooner rather than later. As we demonstrated last week, the likely addition of the Donald to the chart below for a second term means that the $25 trillion of additional debt built into existing UniParty policy over the next decade would grow by another $10 trillion if his ever-expanding list of tax cuts and spending increases are actually adopted. Accordingly, the red bar on the chart would reach $70 trillion by 2034 and upwards of $150 trillion by mid-century.

To be sure, the UniParty apologists are wont to adopt the complacency of the proverbial man falling from a 50-story building, who announced as he passed the 2nd floor: So far, so good!

What that means is that the macroeconomic path we are on is being badly and unsustainably distorted by the massive spending, borrowing and money-printing which underlies the graphic above. This is especially the case with respect to the most recent eight-year period (Q4 2016 to Q2 2024) of truly egregious fiscal and monetary excess.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.