The Pause That Didn’t Refresh—Still More Reason for Abolishing The FOMC, Part 1

Surprise! During the 186 months through August 2023 the Fed funds rate was negative in real terms fully 97% of the time (180 months). But apparently, all it took was just three months of barely positive readings for the Fed to throw in the towel on its rate normalization campaign.

That’s right. As recently as May, the inflation-adjusted Fed funds rate was still -0.48 and turned ever so slightly positive in June and July. Yet the Y/Y trimmed mean CPI still posted at +4.47% in August, meaning that yesterday’s freeze of the target funds rate at 5.33% yielded a real rate of just +0.48%.

Needless to say, there was no valid reason whatsoever for the September meeting pause because a +0.48% real rate is not remotely sustainable or appropriate—no matter what the macroeconomic circumstances might be. The fact is, on the free market the real cost of money would always and everywhere be well above +200 basis points. That’s because there are taxes to be paid at a marginal rate of upwards of 40% on most interest income or 80 basis points of taxes in this instance, and the time value of money—even on short-term deposits—is worth a lot more than the remaining 120 basis points on an annualized basis.

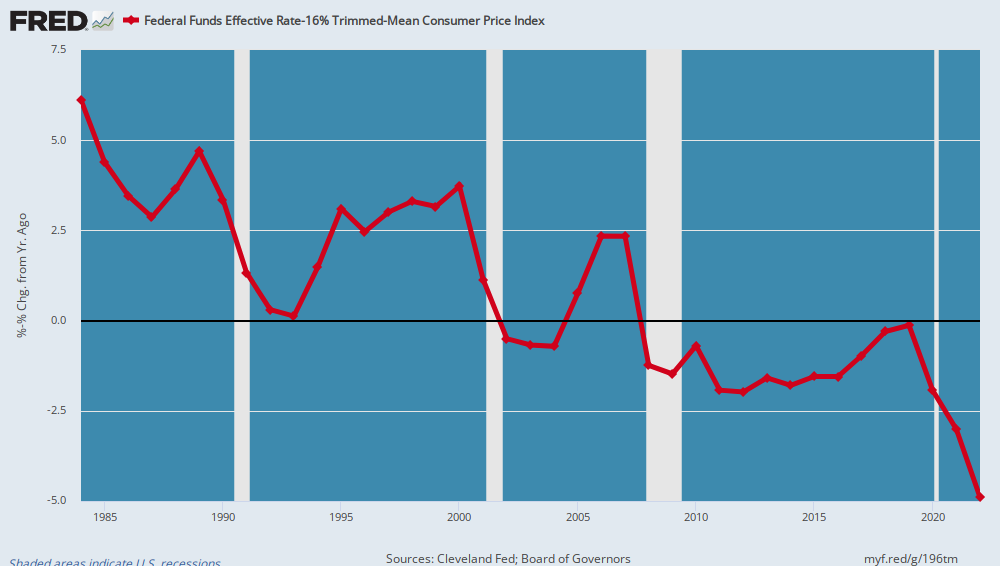

For avoidance of doubt, consider the annual average real Fed funds rates in the chart below, which covers the past 40-years. During the period from 1984 through 2000, the inflation-adjusted Federal funds rate averaged +3.0% and was never negative on an annual average basis. By contrast, over 2008 through 2022, the annual average real rate was -1.7% and it was never positive even once on a full year basis.

So exactly what did the Fed accomplish via this 470 basis points swing to drastically cheaper money? The data suggest that if it was enhanced real growth it had in mind, its efforts came completely a cropper. During 1984 through 2000, real final sales of domestic product rose by 3.52% per annum, while during the super-cheap money period of 2008-2022 that gain shrank to just 1.61% per year.

Nor was this ultra cheap debt an elixir for jobs growth, either. During 1984 through 2000, the average annual growth rate of the nonfarm payroll was 2.16%—a figure 2.9X higher than the tepid 0.74% growth rate during 2008 through 2022.

Inflation-Adjusted Federal Funds Rate, 1984 to 2022

Of course, our Keynesian money-printers are never loath to let facts get in the way. So when it comes to measuring the inflation-adjusted Fed funds rate they go every which way—except the honest way. To wit, they now want us to look at either—

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.