Robert Kennedy recently put the wood to Blackrock co-founder and CEO, Larry Fink, and for good reason. To wit, Fink and his financial colossus is the very living embodiment of Crony Capitalism gone haywire.

“There are three giant corporations: BlackRock, State Street and Vanguard, which own, collectively, own each other, so it’s really one giant corporation, but they also own 89% of the S&P 500. They own everything,” RFK said in what appears to be an interview on “The Breakfast Club.”

“They’ve now decided to buy every single family home in America. If they stay on the current trajectory, they will own 60% of homes in this country … by 2030. They are literally trying to buy everything,” he continued.

RFK Jr. went on to note how BlackRock CEO Larry Fink, who is on the board of the WEF, is part of the cabal pushing for the “great reset.”

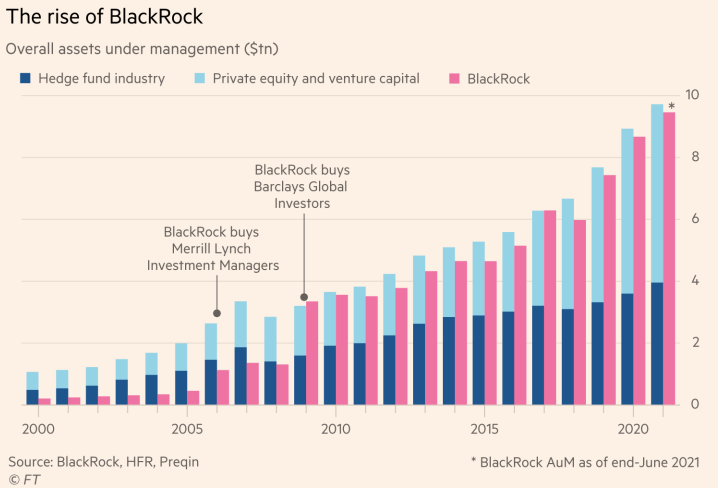

While RFK’s rhetoric may sound a bit overwrought on first encounter, the facts regarding BlackRock’s AUM (Assets Under Managment) leave little to the imagination. The firm’s roughly $10 trillion of AUM—

Exceeds the GDP of all countries in the world except the USA and China.

Matches the combined assets held by the entire hedge fund, private equity and VC industries.

Represents a fifty-fold gain from its $200 billion of AUM just two decades ago (2000).

To be sure, we have nothing against bigness per se—whether it concerns Wall Street, Silicon Valley, the auto industry or other reviled giant enterprises of yore. Throughout history the free market has produced dominant firms based on legitimate economies of scale, technological advances or entrepreneurial innovations, which giants eventually have been caged and superseded by marketplace evolutions and competitors with better or different mousetraps.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.