Trump versus Harris is surely the most miserable presidential choice to ever come before the American people, and not just because both candidates present exceedingly obnoxious, self-obsessed personalities. The real pity is that American prosperity is under assault like never before, yet these cats are are truly in a race to the bottom of the dumpster of bad economic ideas.

To be sure, we were under the impression that it would be hard to come up with something worse than the Donald’s dog’s breakfast of protectionism, multi-trillion unpaid for tax cuts and Big Spending as usual with respect to both the Warfare State and Welfare State. But Harris’ growing pork barrel of spending and tax credit giveaways and proposed reign of Dem-style regulatory lawfare most probably does. We are referring, of course, to her recently proposed idiocy of attacking “price gouging” in the grocery store and food industries, which would need to employ half the lawyers in the beltway to litigate its meaning on a case-by-case basis.

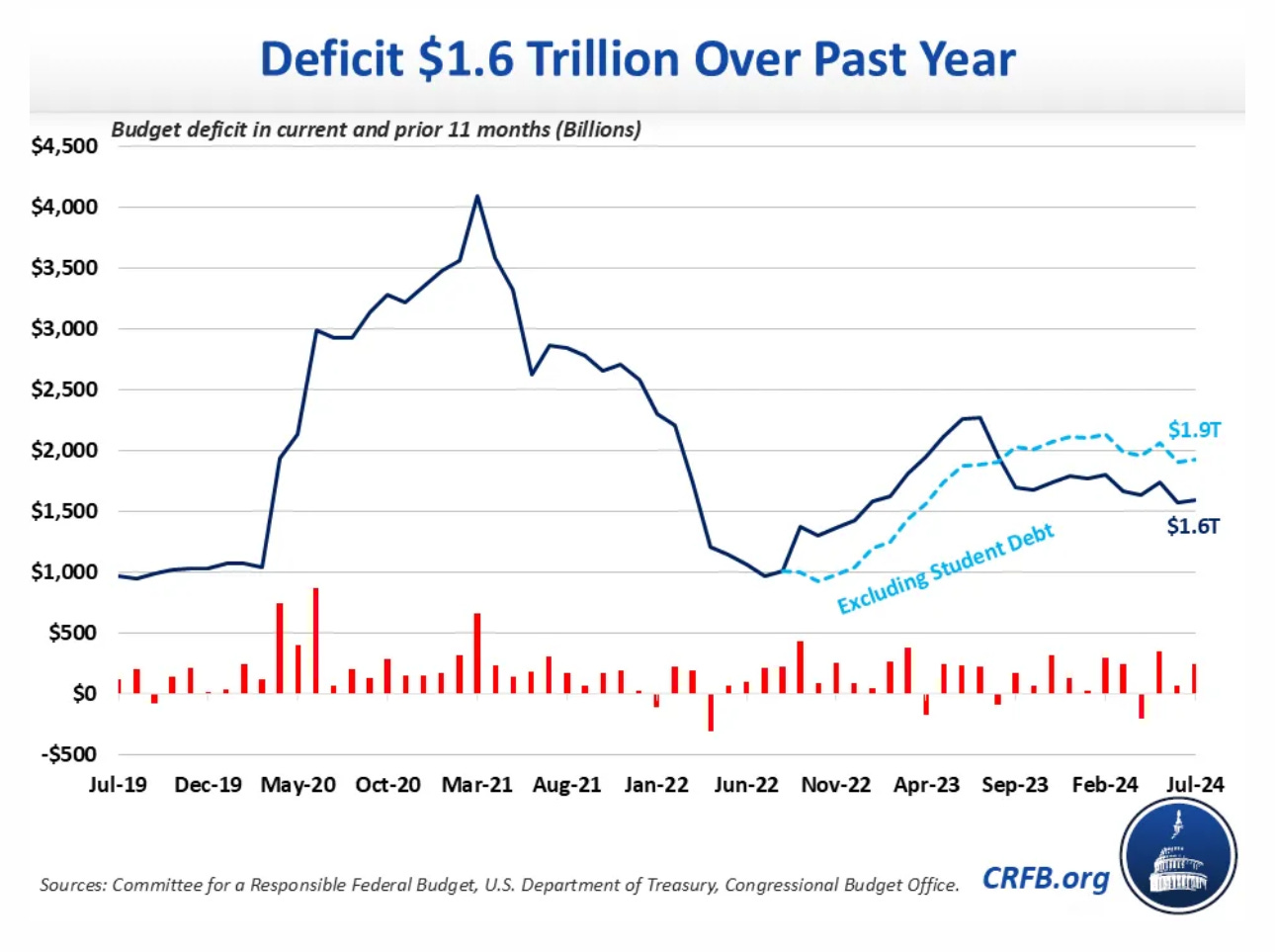

In any event, the place to start with respect to both candidates’ platforms is the fact that the rolling 12-month Federal deficit clocked in at $1.9 trillion in July—and at a moment of alleged full-employment.

Of course, the rapidly rising dotted blue line in the graph (which appropriately eliminates the budget gimmick owing to Biden’s student debt forgiveness plan) is just the warm-up, as it merely tracks what has already happened. Going forward, the annual deficit rises relentlessly to $2.9 trillion by 2034, with the additional red ink cumulating to $22 trillion over the period.

Yet that’s not the half of it. These CBO projections assume that various expiring spending increases and tax cuts will not be extended in the manner that Congress has done time after time at the 11th hour since time immemorial. So if you adjust for politics as usual, the deficits rise by another $6.5 trillion over the next decade. By 2034, in fact, the annual deficit is actually on a path toward $4 trillion per year.

Even then, as the pitch man on late night TV used to say—there’s more!

To wit, under pressure from UniParty politicians on both sides of the aisle, the CBO estimates employ a “no recession ever again” presumption and also assume that inflation quickly relapses to 2.0%, while the 10-year UST yield remains at 4% or under as far as the eye can see.

In short, bring in even modest dose of macroeconomic realism into the equation plus extension of the phony “savings” built into the budget baseline, and you have today’s $35 trillion public debt hitting the $65 trillionmark by the mid-2030s.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.