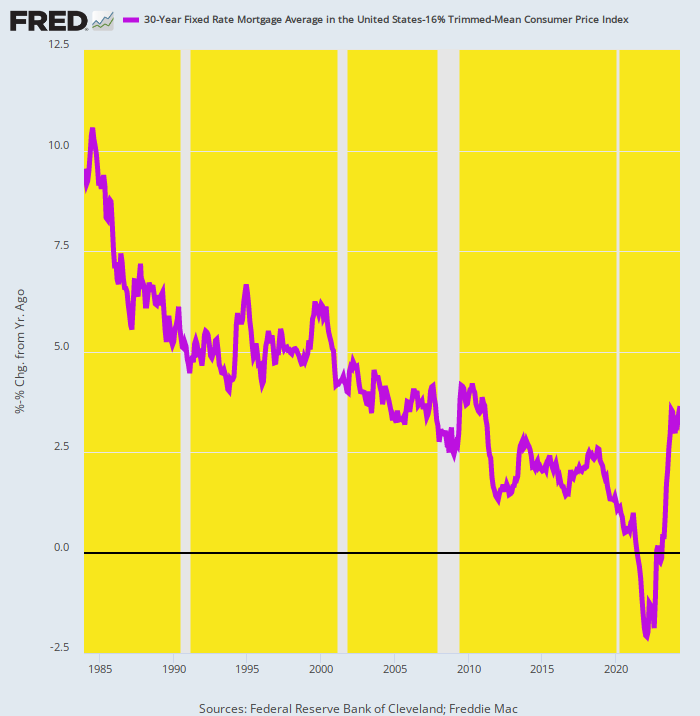

Are these people stupid, or what? When they drove the 30-year mortgage rate off the deep end of history to -2.0% in real terms, did it not occur to the geniuses in the Eccles Building that they would be locking in millions of borrowers to absurdly low rates that they could not afford to jettison?

Apparently not. Owing to this extended dive of the fixed rate mortgage market deep into negative real rate land, more than 90% of newly issued home mortgages in recent years were 30-year fixed-rate loans. That compares to just two-thirds in the run-up to the 2008 housing crash. And now with rates being tepidly normalized again, tens of millions of mortgage borrowers are hanging on to those bargain rates for dear life.

That is, they are not selling, trading-up, moving or refinancing. The wheels of the residential housing market are therefore slowly grinding to a halt.

To be sure, millions of households that refied into ultra-low fixed rates–often multiple times— can now afford to spend more elsewhere. The average US mortgage holder, in fact, has accumulated $119,000 of additional equity over the past four years.

In turn, this “wealth effect” spending prop is surely one reason why that Fed’s interest rate hammer has been so slow and anemic in attempting to cool the macro-economy and bring inflation back to its sacred 2% target.

Inflation-Adjusted 30-Year Fixed Mortgage Rate, 1984 to 2024

Then again, what’s the point? When current mortgage rates (red line) were below the embedded average rate on all mortgages outstanding (yellow line), the refi, trade-up, move-away and fix-up process in the residential housing market went into overdrive, pulling forward activity that would have eventually happened anyway. In that context, Lowe’s, Home Depot, real estate brokers, contractors etc. prospered mightily.

Now, not so much. As shown in the second graph below, the lines have decisively crossed. Not only are brokers’ fees, contractor orders, lumber sales and foot-traffic at Home Depot slowing sharply, but new home buyers are getting hit with a double whammy. Existing locked-in borrowers are not putting their homes on the market, with supply of existing homes for sale at two decade lows. Consequently, a supply-demand pinch is once again sending housing prices skyward.

When all is said and done, real housing market activity will have simply been shuffled around in time, while yet another round of residential house asset price inflation will have been triggered. And the resulting windfall gains and losses to homeowners, borrowers, brokers, bankers and contractors will have been utterly capricious in its impact.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.