The Fed’s Fake Victory Over Inflation

If you don’t think the Fed has become an abject handmaid of the Wall Street gamblers, take a gander at the chart below. Owing to the slight down-tick in this week’s monthly CPI report, the outcry for rate cuts is reaching a deafening roar down in the trading pits. And judging by Powell’s presser on Wednesday, the Fed is fixing to bend over soon, bar of soap in outstretched hand.

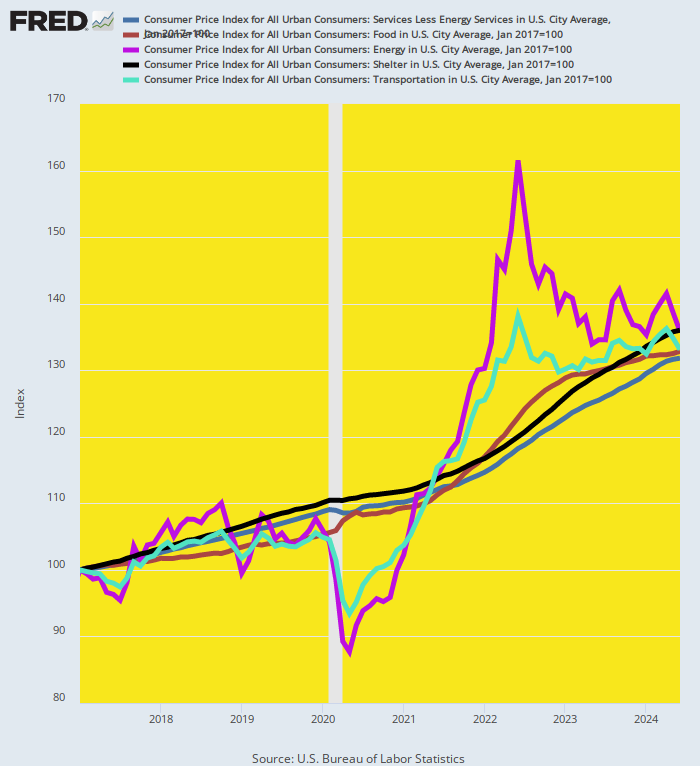

And yet and yet. On everything that makes a difference to the main street cost of living, prices are up by 32% to 36% during the period of UniParty rule since January 2017.

That’s right. Among the five biggies—services, food, energy, transportation and shelter—that comprise an overwhelming share of main street family budgets, the rate of price increase during the last seven-and-one-half years is close to 4.0% per annum! And for want of doubt, that rate of gain means that prices would double every 18 years.

Moreover, despite drastically different short-term paths since January 2017 to get to the present index levels, the cumulative gains over this 7+ year period for these five essentials are bunched quite tightly at the 4.0% per annum mark. Among other things, this reminds that what counts is the cumulative inflation over a reasonable period of time, and that monthly movements of even major CPI components are definitely not a reliable guide to the longer-term path of the general price level.

CPI Component Increases Per Annum Since January 2017:

Services less energy services: +3.8%.

Food: +3.9%.

Transportation:+3.9%.

Energy: +4.2%.

Shelter: +4.3%.

Index Of Major CPI Components Since January 2017

Back in the day, of course, the core mission of central bankers was price stability over time, not statistical game-playing based on the annualized rate of inflation for short, arbitrarily chosen periods. And the focus was also on a stable general price level, not the present preoccupation with all manner of sub-components of the CPI or PCE deflator and tortured sawed-off variations of the overall indexes.

For instance, awhile back all the rage was the so-called SuperCore CPI, which covers services minus shelter services. Of course, that meant that over 60% of the weight in the CPI market basket was being deleted from the figure, but, hey, Wall Street economists claimed this particular sawed-off inflation ruler stood at the top of Powell’s data dashboard.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.