Wall Street was beating the tom-toms for a “soft-landing” again today after the Labor Department reported a 1.1% decline in unit labor costs for Q3. This was purportedly another sign that the Fed’s battle against inflation is being won.

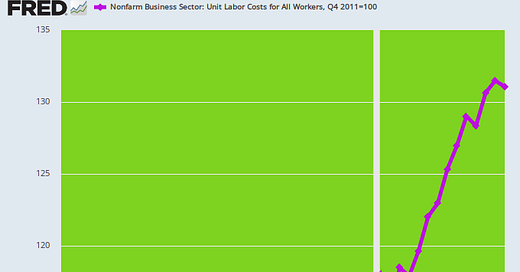

Well, no, we are not providing magnifying glasses for the purpose of examining the tiny downward hook for Q3 2023 in the upper right-hand corner of the attached graph. But we can note that there have been eight previous quarter-long downward blips in unit labor costs since the Fed officially embraced its 2.00% inflation target in 2012, and also that, nonetheless, the figure reported today was 31% higher than when the Fed officially boarded the pro-inflation bandwagon in January 2012.

And that gain is not just some ordinary 31% rise in still another economic metric. The truth is, in a world of sound money and functioning free markets, unit labor costs would not rise at all. That’s because wage cost increases would always be exceeded by productivity gains under conditions of supply-demand balance; and even in the event of labor shortages, rising wage rates would attract labor supply expansion from the existing population or from newly arrived immigrant workers, thereby clearing wage markets at levels consistent with productivity growth.

As it happens, the 2.33% per annum rise in unit labor costs since 2012 actually understates the case. During the five years after Q3 2018, unit labor cost growth actually accelerated to 3.13% per annum. So either the Fed means to crush profits owing to costs which keep rising far faster than productivity growth or it intends to embed inflation into the cost structure of the economy in a manner which will permanently wreak havoc with both good jobs and middle-class living standards.

After all, inflation of 3.13% per annum for another two decades would reduce the purchasing power of the dollar by -47% and raise domestic unit labor costs by +85%. Under that scenario is it reasonable to believe that good American jobs would not continue to drift off-shore?

By the same token, why in the world would a 48-year-old save $1 today if it were going to be worth only 53 cents during even their first year of retirement?

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.