The Denarius, The Dollar And The Dungeon Below The Zero Bound

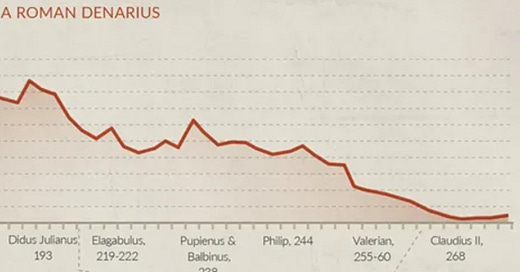

Well, here’s an interesting historical repeat. Apparently, it took the Roman Empire about 200 years to reduce the value of its currency, the silver Denarius, by 95%. As shown in the chart below, the silver content of the Roman currency had been nearly 100% at the peak of the Empire in 65 AD, but by 268 AD the coin had been clipped and debased so thoroughly that it was comprised of less than 5% silver.

Needless to say, inflation became rampant, causing the financial foundation of the Roman Empire to eventually collapse. In the process, future generations and nations got an unmistakable lesson: Debauching the money is absolutely not the road to sustainable prosperity.

Unfortunately, that has not prevented governments from attempting the currency depreciation route again and again. In our own era, the 111 year history of the Federal Reserve provides a striking case in point. In roughly half the time it took the Romans, the Fed has managed to accomplish the same 95% depreciation of the US dollar.

That’s right. The purchasing power of the consumer dollar as measured by the CPI has dropped from 100 cents when the Fed opened for business in 1914 to barely 3 cents today.

Index of Dollar’s Purchasing Power Since 1914 As Measured By The CPI

And yet and yet. After the most recent surge of inflation, the Fed is at it again. In today’s Congressional testimony, Chairman Powell as much as claimed victory and implied that the next round of rate cuts would soon commence, perhaps as early as September.

Reducing policy restraint too late or too little could unduly weaken economic activity and employment,” Powell said as part of his semiannual update on monetary policy. “More good data would strengthen our confidence that inflation is moving sustainably toward 2 percent.”

Let’s not mince words. What in the hell is he talking about?

The implication is that the Fed never has to make amends. If the inflation genie gets out of the bottle and pushes the general price level sharply higher, why the thing to do is to just brake the surge and advise the people to lick their wounds with respect to the depleted value of their savings and the waning purchasing power of their paycheck.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.