The $50 Trillion Elephant In The Room

At the end of the day, it’s about the stocks, not the flows. Yet we operate in a thoroughly Keynesian world where the former are ignored almost entirely by Wall Street and Washington alike.

Well, except when balance sheets explode and everyone is suddenly caught up like deer in the headlights amidst an unexpected “financial crisis”. Again and again.

In the artificial world of flows, of course, the only thing that matters is the incoming data and the embedded deltas from last week, month, quarter or year. That is, what’s the latest level and rate of change in retail sales, housing starts, nonfarm payroll jobs, quarterly GDP, PCE and non-resi fixed investment etc—along with the core PCE deflator and the Fed’s target for interest rates at the next 25 basis points interval?

To be sure, if “policy” were both sound and unchanging, the “flows” preoccupation would be reasonably serviceable. All cycles would be pretty much the same, meaning that extrapolating from past trends would likely generate accurate forecasts of the future.

In no way, shape or form. however, does a policy constant and timeless cycle characterize the current world. To the contrary, government policy keeps getting worse and more capricious with each passing year and decade, causing its impact on the business cycle and the temporal flow of activity to be ever more heavy-handed and unpredictable.

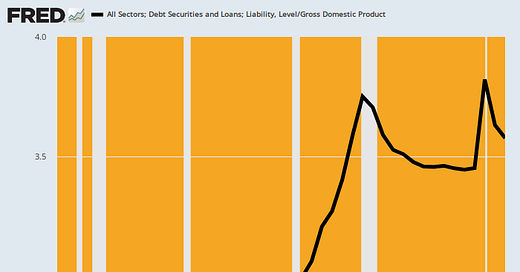

As a result, the cycle does not repeat itself, but evolves unpredictably owing to a progressively heavier stock of dodgy balance sheet conditions. And, perforce, at the heart of this lies the toxic spawn of all the government stimulus and money-printing that has been going on for upwards of five decades now. To wit, the massive mushrooming of debt in every sector of the economy—households, business, finance and government.

Owing to the Keynesian blinders, however, mainstream analysts are not able to make the leap from the micro to the macro. On the one hand, if a company’s debt went from 1.6 to 3.6 turns of income over a period of time, analysts would readily incorporate that condition change into their assessments and expectations for future performance. But when it comes to the macro level, neither the analysts nor the models even bother with the stock of debt and the resulting balance sheet ratios.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.