Thanks Fed! The Road To Fiscal Armageddon

It would appear that it’s all over except the shouting. But it’s not. Not even remotely.

We are referring to the public debt crisis, of course, which did not end with the McCarthy sell-out a few weeks back. Actually, it is just getting started—and there is no better telltale sign than the graph below.

Just 18 months ag0 the trailing 12-month (LTM) interest payment on the public debt clocked in at $350 billion. Last month the LTM interest payment was already up to nearly $600 billion. So Washington has added an extra quarter trillion dollars per year in debt service—just during the most recent period of phony partisan posturing over “the credit of the United States”.

For crying out loud. Absent the Fed’s massive and reckless monetization of the public debt in recent years the credit of the US would have been in the shitter long ago. The same is true for the Wall Street gamblers and the financial engineering driven C-suites of corporate America, who were otherwise enabled to lap-up mountains of ultra-cheap debt basically to buy-back their own stock or that of rivals via cash-based M&A deals.

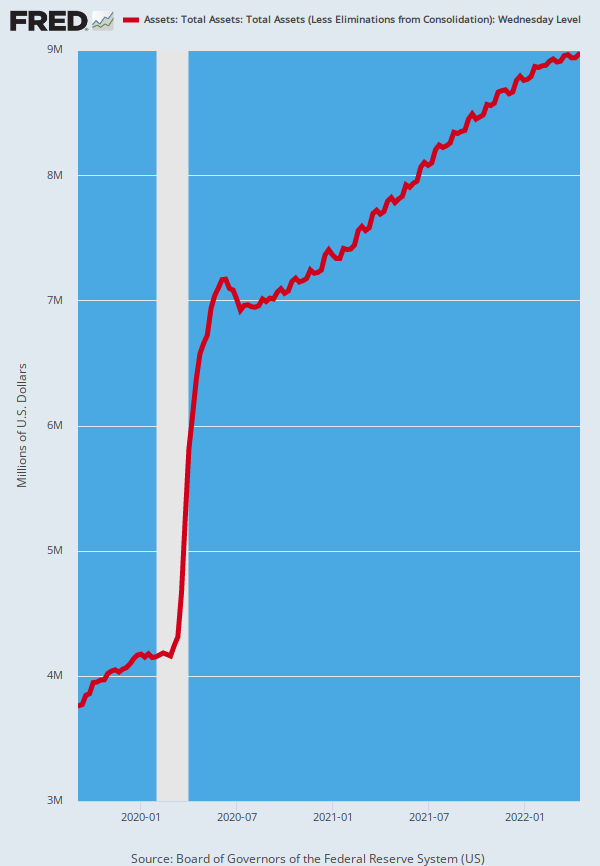

As it happened, in barely 30 months between September 2019 and April 2022, the Fed’s balance sheet exploded by $5.2 trillion. That represents a 42% per annum growth rate—in the event that anyone is counting.

This money printing madness essentially savaged the law of supply and demand, causing debt markets to clear at sub-basement yields far, far below where honest free markets would have priced the tsunami of debt flowing from the public and private sectors, alike.

Fed Balance Sheet, August 2019 to April 2022

In turn, this extended period of radical rate repression afforded the US Treasury an opportunity to refi much of the public debt virtually for free. As shown below, after one year of mad-cap money-pumping by the Fed, interest rates were effectively zero on all maturities of UST paper out to two years.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.