Thanks Fed! The FDIC Dunk Tank Awaits More Victims

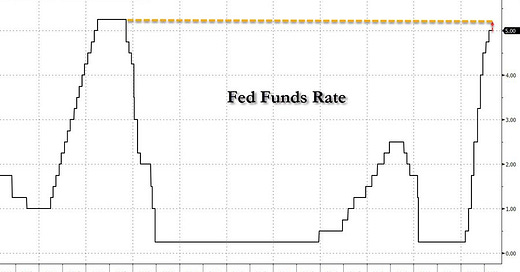

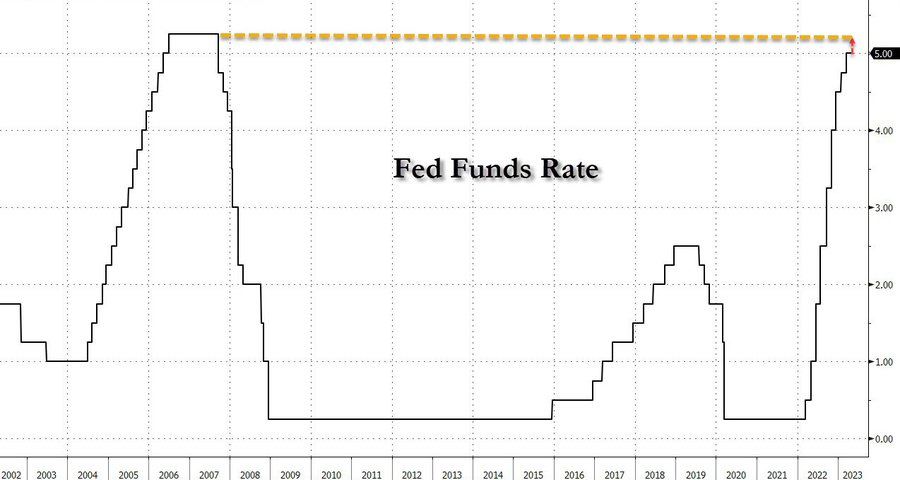

There was a lot of jaw-flapping this AM about the Fed’s impending increase of its policy rate to 5.25%. That happens to equal the peak rate attained during the 2004-2006 tightening cycle, and represents, according to the talking heads, a pretty punishing climb from the zero bound where it stood in March 2022.

The point of all this palaver, apparently, is that the Fed funds rate in now getting real high by historic standards and it’s therefore time to “pause”, with a pivot lower waiting at the ready in the wings.

Actually, there is nothing high about it. There have been three so-called tightening cycles since 2001. Inflation-adjusted rates were barely positive during February 2005 to 2008, microscopically positive during 2019 and not even there yet this time around the barn.

More importantly, when you look at the entire picture since October 2001—after rates were first pressed to near the zero-bound by Alan Greenspan in a desperate move to cure the dotcom crash—the monetary verdict is stunning. To wit, during 83% of the 257 months since then, the Fed’s policy rate has been negative in real terms.

That surely deserves repetition: Since the turn of the century there have been the equivalent of 17 years in which short-term money was free and then some!

And folks we are making the calculation embedded in the purple bars below in an honest injun fashion. To wit, this is a longish period of time—virtually the entire 21st century to date— and the inflation proxy we are using is the trusty 16% trimmed mean CPI.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.