Stop The Fed, Stop The Debt

If you want to understand why US fiscal policy has gone to hell in a handbasket, the chart below tells you all you need to know. To wit, after Greenspan went full retard at the Fed’s printing press in response to the dotcom crash, a yawning gap opened up between the soaring level of the Federal debt and the far more modest increase in Federal interest expense.

Accordingly, by the eve of the Fed’s belated pivot to inflation-fighting in March 2022, the public debt (purple line) had risen by 413% from its January 2000 level, but interest expense (black line) was still only 73% higher.

In dollar terms this amounted to a +$24 trillion rise in the public debt while annual interest expense increased by only +$250 billion. The implied incremental carry cost, therefore, was just 1.1% of the mountainous rise of the public debt. It’s no wonder the nation’s politicians borrowed and spent like there was no tomorrow.

Change In Public Debt Versus Federal Interest Expense, 2000 to 2021

Obviously, the above picture defies common math or any sound notion of economic relationships. Still, there is no mystery about why the public debt rose by 5.7X the increase in interest expense during that 21-year period. Simply put, the monetary central planners at the Fed pushed interest rates sharply and persistently lower, and by more than enough to make up for the soaring debt principal that Uncle Sam had to service.

So doing, however, the nation’s unelected central bankers peppered Capitol Hill with financial error messages that were biblical in scale. The false implication was that officialdom could borrow with reckless abandon, yet not have to pay the piper by raising taxes or cutting other spending programs to fund the interest.

That implicit free lunch axiom was the inverse of the reality that had previously kept the propensity of democratic politicians to borrow and spend in check. Back in the time of the inflationary 1970s and during the subsequent brutal Volcker efforts to curtail it, for instance, politicians dreaded the prospect of “crowding out”. That refers to the natural supply and demand dynamics which occurs in the bond pits of Wall Street when Uncle Sam charges in with sharp elbows flying to scarf-down massive amounts private savings to fund the ballooning public debt.

Back then politicians weren’t especially more virtuous than today’s crop with respect to fiscal morality. But they did wish to get reelected. And in the Volcker era, the Fed was not about to monetize Uncle Sam prodigious debt emissions, meaning that the public debt got financed the honest way out of private savings, which in turn meant sharply rising interest rates and ballooning costs for car dealers, manufacturers, homebuilders, farmers, retailers and mortgage borrowers back home.

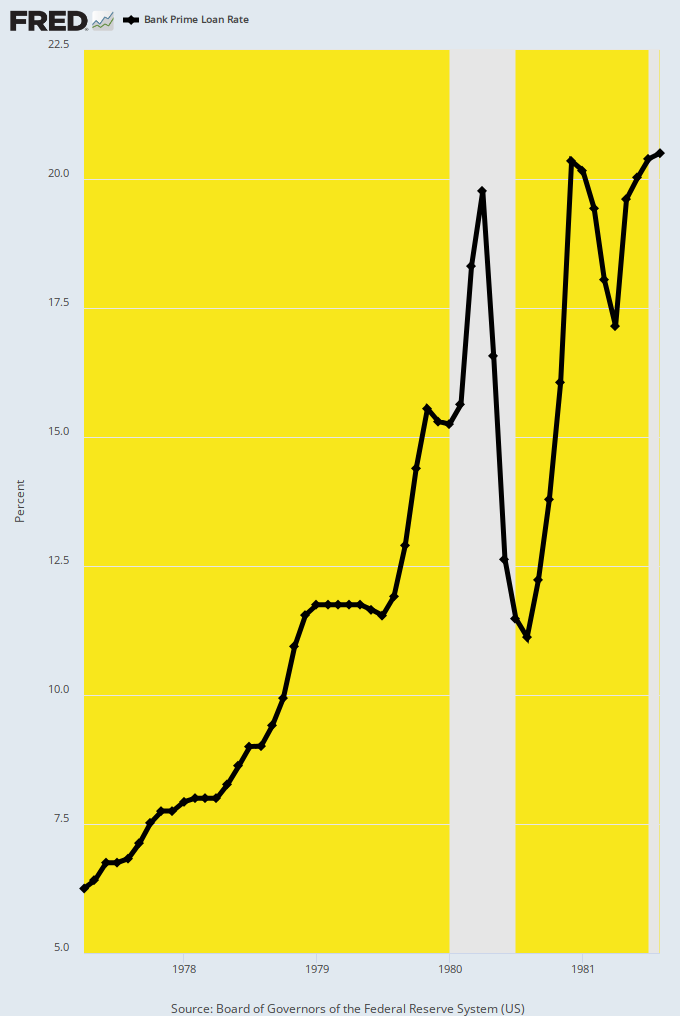

During those times much of the business sector borrowing for working capital and even many longer-term projects was financed at the prime rate for bank lines. Yet, as shown below, the Fed permitted the prime rate to soar by 1,425 basis points during the four years after April 1977.

As it happened, Jimmy Carter quickly became a one-term president because the collateral damage on hometown businesses and households from his rising deficits and soaring interest rates could not be hidden from the voters. As much as anything else, the honest bond market finance of the Carter deficits is what put Ronald Reagan into the Oval Office.

Prime Rate Of Interest, 1977 to 1981

As the carry cost of borrowing soared per the above path of rates, the private sector victims of Washington profligacy made themselves heard and loudly so. Indeed, honest deficit finance in the bond pits generated an automatic feedback loop into the political system, providing a powerful counterpoint to the endless demands of the special interest groups and policy constituencies that feed at the public trough on Capitol Hill.

But once Greenspan started up the printing presses, it was off to the races. The public debt rose from $2.3 trillion at the time he took the helm at the Fed in August 1987 to $8.4 trillion when he handed the baton to Bernanke in early 2006; and from there it was on to $34.5 trillion at the current moment, which will become $37 trillion by year-end, $40 trillion next year, $60 trillion before the end of the current decade, and $100 trillion by the early 2040s.

The above fantastic public debt figures are hardly even debatable because neither Trump nor Biden have the remotest interest in or plan to stop the built-in fiscal doomsday machine that is now embedded in the Federal budget. The major components of the current track to fiscal oblivion include:

The UniParty war consensus that has generated a $1.3 trillion national security budget that is orders of magnitude more than America’s homeland security actually requires.

The vicious Democrat demagoguery and GOP cowardice about the nation’s massive transfer payment schemes which will cost upwards of $50 trillion over the next decade, as a prelude to even far higher expense thereafter as the nation’s retirement rolls hit 100 million by the middle of the century.

Long-term Federal tax collections at barely 17% of GDP owing to the GOP’s serial deficit- financed tax cuts since 2001 compared to baseline spending which will hit 25% of GDP during the decade ahead.

A drastic widening of that huge 8% of GDP structural deficit after the early 2030s, as self-feeding interest costs explode higher in the decades beyond.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.