Ooops!

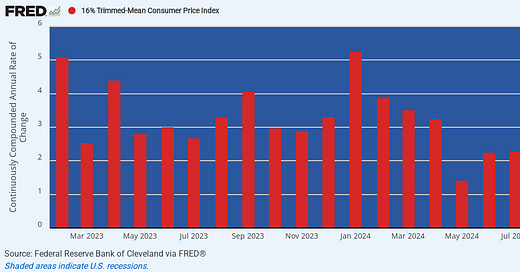

Our trusty 16% trimmed mean CPI just posted at a +5.0% annualized rate for January 2025. So doing it has relapsed back to the level of February 2023 when Fed fanboys on Wall Street began chirping that inflation was being squeezed back into the 2.00% bottle with alacrity.

Well, apparently not. And worse still, the Fed heads now find themselves caught with their pants down. They have cut the Fed funds rate by 100 basis points since September—yet a declaration of “mission accomplished” with respect to elevated inflation readings remains as remote as ever.

Annualized Rate Of Monthly Change in 16% Trimmed Mean CPI, February 2023 to January 2025

Moreover, when you dial back to a more stable and meaningful Y/Y measure, the Fed’s abysmal failure at the true mission of a central bank—-maintaining sound money— is even more evident. During the quarters before the disruption of the pandemic lockdowns and stimmies in March 2020, this core inflation measure—which removes the highest and lowest inflation outliers each month—was running at a tad over 2.0%.

It then surged to a 40-year high above 7% owing to the double whammy of supply shortages and massive fiscal and monetary stimulus—-$6 trillion of the former and $5 trillion of the latter. But as is now evident on the right hand margin of the graph, the 16% trimmed mean CPI has subsequently settled pretty solidly in the +3.0% year-over-year range.

That’s right. The geniuses in the Eccles Building have landed the plane at a 50% higher trend rate of inflation, yet are still gumming that more ease is coming, albeit at a slightly slower pace then previously anticipated.

Then again, it needs be reminded that sound money does have a purpose, which is called maintaining the purchase power of the money over time. Yet at the Y/Y inflation average of the last 12 months shown below, the dollar’s buying power would be just 71 cents just one decade from now.

Call that severe depreciation or debauching the money, if you will. But surely “sound money” has absolutely nothing to do with the path that has been carved by the Fed , as shown below.

Y/Y Increase In the 16% Trimmed Mean CPI, January 2019 to January 2025

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.