Powell & Co—Monetary Whores Of Wall Street

If the monetary central planners in the Eccles Building cared a whit about enabling the workers, entrepreneurs, savers, investors and consumers of America to maximize capitalist prosperity on main street, they’d be worried to death about the collapse of private savings. After all, what lifts an economy above day-to-day subsistence is capital formation. And that wondrous process first and foremost requires deferred gratification and society’s accumulation of savings out of current income.

As history readily shows, so long as an incentive in the form of real returns to savings exists, the natural impulse toward “eat, drink and be merry” does not rule the day.

Of course, that puts our Keynesian central planners in direct opposition to the core rudiment of capitalist prosperity. Professor J.M. Keynes insisted that mankind was prone to save way too much, allegedly a trick of the coupon clipping classes designed to rob workers of the extra pint of ale that might come with a more robust level of aggregate consumption and spending. So Keynes’s core policy was to force interest rates lower than the market would otherwise produce, thereby causing the “euthanasia of the rentier”:

“Interest today rewards no genuine sacrifice . . . The owner of capital can obtain interest because capital is scarce . . . [But] there are no intrinsic reasons for the scarcity of capital. . . . I see, therefore, the rentier aspect of capitalism as a transitional phase which will disappear . . . It will be, moreover, a great advantage of the order of events which I am advocating, that the euthanasia of the rentier, of the functionless investor, will be nothing sudden, merely a gradual but prolonged continuance of what we have seen recently . . .

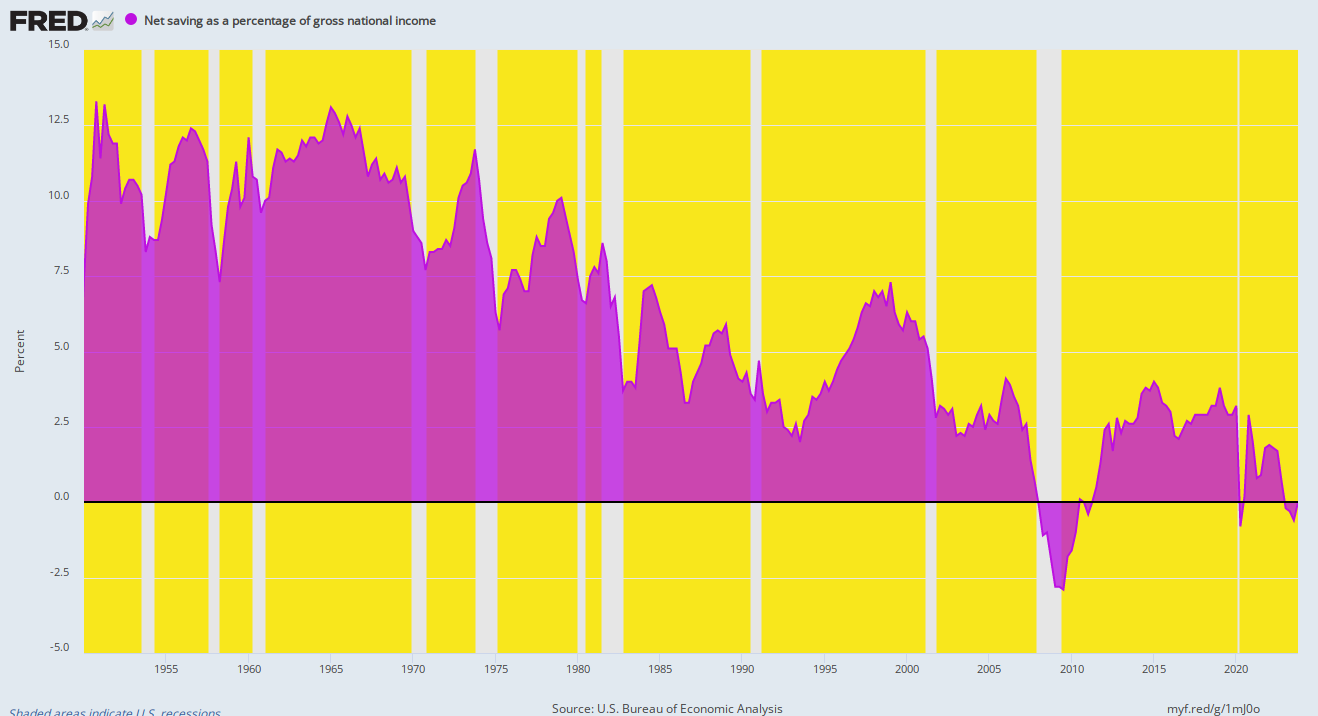

Keynes was more clairvoyant than even his ample ego understood. Here is the US net national savings rate over the last seven decades. As Keynesian policy became ever more deeply embedded in the double-whammy of bigger and bigger public sector deficits and lower and lower interest rates pegged by the Fed, savings at length have totally disappeared.

That is to say, the private savings rates of households and businesses fell sharply, while the public sector borrowing absorbed more and more of what remained.

Accordingly, what was a 10% net savings share of GDP set aside for investment in productivity and growth in the post-war heyday of American prosperity has now diminished to 0.0%, and often to even negative rates of savings available for capital formation. And it is chronic ultra-low interest rates forced on the economy by the central bank that fully explains the ruinous trend depicted in the chart below.

Net National Savings As % Of GDP, 1950 to 2023

Ironically, this Keynesian anti-savings bias has turned out not to be the death of the coupon clippers, but actually financial music to Wall Street’s ears. When it is recognized that the good folks in the canyons of Wall Street are not apostles of the Almighty pursuing the salvation of mankind, but at the end of the day are actually glorified speculators looking to make a fast buck, the fatal attraction of low interest rates becomes self-evident.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.