Now Comes Trump’s Turn In The Economic Dunk Tank, Part 2

In Part 1 we identified the $5 trillion flood of printing press money that financed the Covid relief spend-a-thons, thereby turning what would otherwise have been a Trumpian interest rate crunch, financial crisis and recession into an inflationary gale during 2021-2023. In effect, Biden/Harris drew the short straw when it came to whose watch would actually experience the cost-of-living storm.

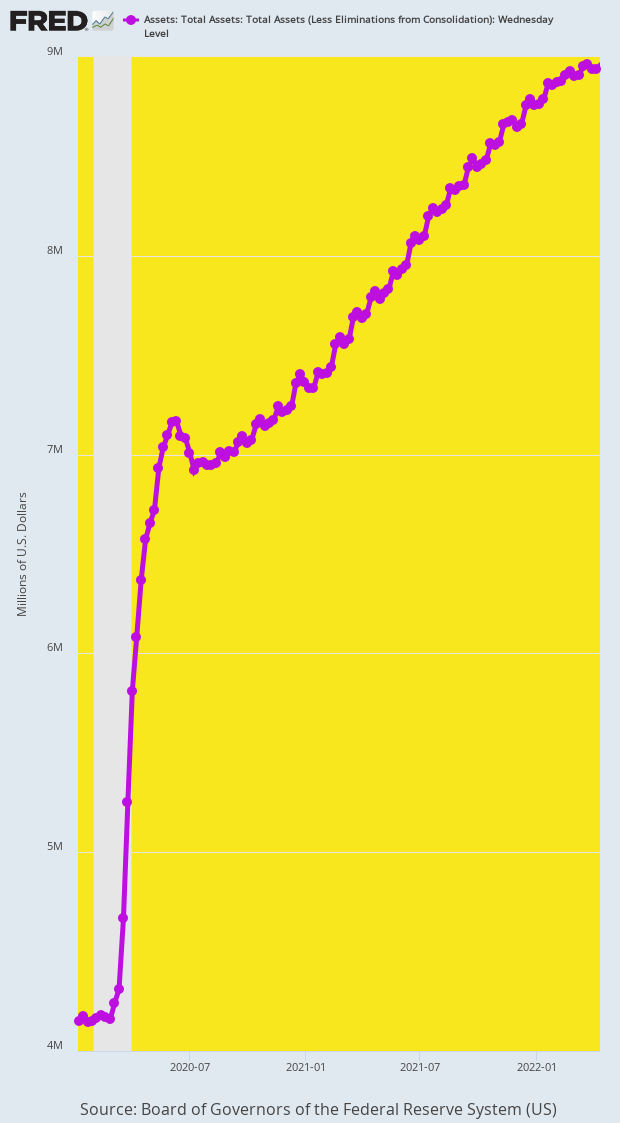

That’s right. Between February 2020 and April 2022, the Fed’s balance sheet exploded from $4.1 trillion to $9.0 trillion. That meant the Fed printed in 27 months 120% of all the fiat credit it had generated during the first 107 years of its existence. If there were ever a smoking gun explanation for a sudden burst of 40-year high inflation, the chart below is surely it.

Federal Reserve Balance Sheet, January 2020 to April 2022

And yet and yet. The UniParty pols on the banks of the Potomac have been so bamboozled by the hideous myth that the Eccles Building is the financial Good Shepard of the American economy that they look the above monetary monstrosity squarely in the face and respond with piddling partisan talking points. That is, the GOP pols say the stink of Bidenomics caused the recent inflation surge and the Dem pols say it was due to “gouging” by the likes of Kroger and General Mills.

Well, no, it was the Federal Reserve which caused the inflation eruption as depicted below by the annualized rate of monthly change in the 16% trimmed mean CPI. For the full eight years from December 2012 to December 2020 the index oscillated around the 2% mark, averaging exactly 2.00% per annum over the period from beginning to end.

Moreover, as it happened the 4-year average during Obama’s second term posted at 1.84%, while the Donald’s thru February 2020 came in at a 2.18% per annum rate. But then, suddenly, the index took off like a bat out of hell, rising at a peak 9.0% annualized rate by September 2021.

Needless to say, “Joe Biden” didn’t precipitate that rocket-ship lift-off all on his/their/its own, owing to the bad odors of Democrat economics. In fact, Federal spending per se doesn’t cause inflation—it’s caused by monetized Treasury borrowing, which per the above chart was already in high earth orbit when Joe Biden shuffled into the Oval Office.

So, yes, the famous monetary policy “lags” fingered by Uncle Milton Friedman decades ago functioned in this instance to gift the Donald’s inflation to the “Joe Biden” entity. It wasn’t just Democrat policy stink that caused the eruption in the chart below, as the Sean Hannity/GOP partisans would have you think. Nor did “Joe Biden” cause it to cool to the 3.3% annualized rate of gain posted in November 2024, either.

To the contrary, this chart is the work of the rogue central bankers domiciled in the Eccles Building. In just the short 12-year period encompassed below, they have reduced the purchasing power of the consumer’s dollar by 27%, fueled a massive bubble on Wall Street and a related $27 trillion net worth windfall gain to the top 1%, and led the UniParty politicians on Capitol Hill to believe that they can spend and borrow with impunity.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.