Not Your Grandfather’s Recession

Here’s a wake-up call. Notwithstanding 478 basis points of increase in the Fed funds rate and rising Wall Street lamentations about the fastest Fed rate rise in four decades, the inflation-adjusted yield on the 10-year UST (and benchmark security for the entire global financial system) was still -2.1% at the end of February.

That is to say, it’s nearly at the point where Volcker started 44 years ago, when he inherited a -2.5% yield in August 1979. Thereafter, of course, he pushed the real rate on the 10-year UST to +4.6% two years later and ultimately to +8.7% in September 1983. Overall, the Volcker anti-inflation campaign encompassed more than 1,000 basis points of upward shift in the real benchmark cost of debt.

Inflation-Adjusted Yield On 10-Year UST, 1979 to 2023

At length, the CPI came tumbling down, as the normalization of money costs put the kibosh on excessive speculation and artificial spending levels. In turn, this weened the US economy from its credit-driven demand binge, returning it to a sustainable growth path based on production and the income and spending which flow from it.

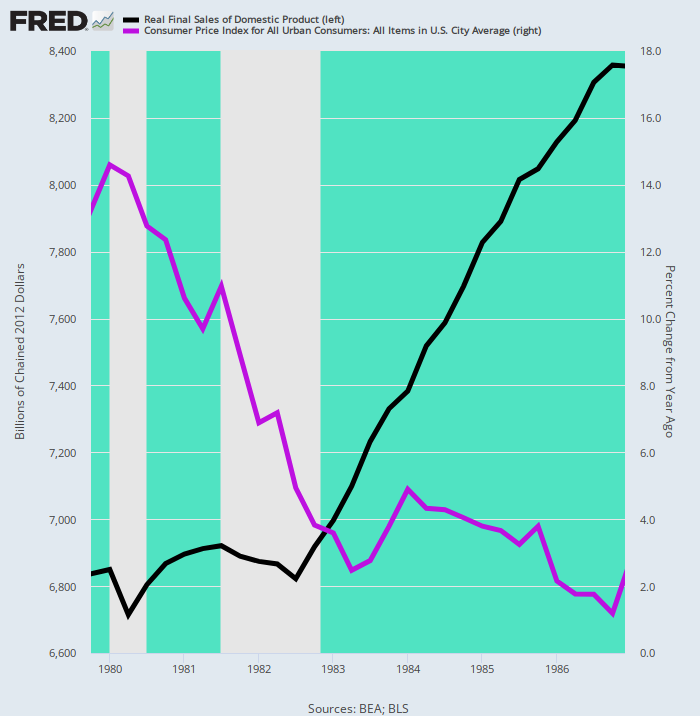

For a brief interval, therefore, the Volcker Fed liberated the supply-side of the US economy from the inflationary distortions and growth roadblocks fostered by the rampant Fed money-printing of the 1970s. In fact, even as the Y/Y CPI increase plunged from 13.3% in Q4 1979 to just 1.2% in Q4 1986, real growth posted the best four-year string of recent times.

Say’s Law was once again triumphant, with the economic sequence flowing from production-to-income-to-spending for consumption and investment. Meanwhile, the hoary claim of the Phillips Curve trade-off between inflation and employment was buried once and for all. The “X” in the chart below depicting a rapidly expanding economy and plunging inflation rates leaves no room for doubt.

Q4/Q4 Change In Real Final Sales Of Domestic Product:

1983: +6.0%;

1984: +5.0%;

1985:+4.6%;

1986: +4.0%

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.