Market capitalism isn’t working according to the texts penned by Adam Smith, and hasn’t been for decades. Still, there is a reason why today’s bailout-ridden crony capitalism is not remotely the real thing: To wit, free markets can’t function efficiently and productively when they are flooded with cheap credit printed by the central bank.

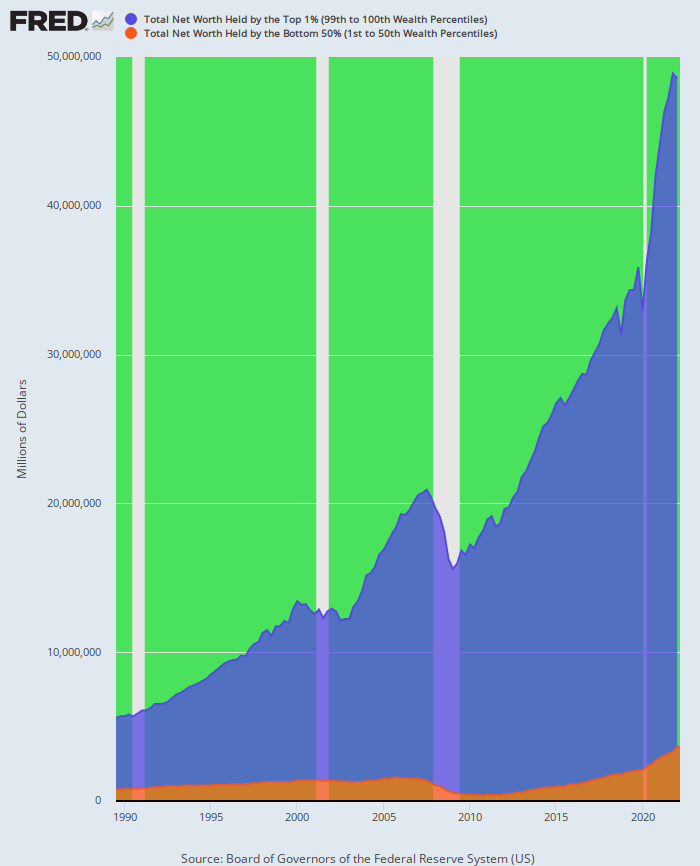

The ill effects of this monetary perversion are legion, but one of the most obnoxious is massive financial windfalls to a tiny elite of the wealthy and a concomitant depletion of the middle class. Thus, in 1989 the collective net worth of the top 1% of households weighed in at $4.8 trillion, which was 6.2X the $775 billion net worth of the bottom 50% of households. By Q1 2022, however, those figures were $45 trillion versus $3.7 trillion, meaning that the wealth differential was now 12.2X.

In round numbers, therefore, the top 1% gained $40 trillion of wealth over that 33-year period compared to the mere $3 trillion gain of the bottom 50%. Stated differently, there are currently 65 million households in the bottom 50%, which have an average net worth of just $56,000. This compares to the 1.2 million households in the top 1% which currently sport an average net worth of $38,000,000.

Net Worth of Top 1% Versus Bottom 50%, 1989 to 2022

Needless to say, there is no reason to believe that left to its own devices free market capitalism would generate this 680:1 wealth differential per household. Indeed, three decades ago—and well before the Fed went into money-printing overdrive—the per household wealth differential between the top 1% and the bottom 50% was barely half of today’s level.

Back in the heyday of America’s post-war prosperity, in fact, President Kennedy’s famous aphorism that “a rising tide lifts all boats” was repeatedly confirmed. For instance, between 1953 and 1973, constant dollar (2022 $) median family income rose from $38,400 to $67,000. That 2.8% per annum gain was nearly five times larger than the 0.59% per annum gain in real median family income since the year 2000.

Median Real Family Income, 1953 to 1973

Needless to say, that drastic slowdown in the growth of middle-class living standards occurred once Alan Greenspan inaugurated the current era of rampant central bank money printing, stock market coddling and egregious bailouts. Accordingly, the more accurate characterization for the current era is that a rising tide mainly has been lifting all the yachts.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.