More Fed Follies: Why All Those “Jobs” Aren’t What They Are Cracked-Up To Be

Not surprisingly, after Friday’s 339,000 job gain for May they are gumming loudly again about the “strong” labor market and economy, even if 201,000 or 60% of this gain was in government, health and education and leisure and hospitality jobs.

We wonder, therefore, as to what is so strong about a labor market which is going backwards on the productivity front owing precisely to these kinds of low value-added jobs. In fact, the index of private sector labor productivity (black line) peaked in Q3 2020 and is now nearly -2% lower, even as the index of aggregate labor hours (purple line) has risen by nearly +10% during the same period.

In effect, the US economy is substituting low-skill labor for capital, which is the very opposite of the historic route to higher wealth and living standards.

Index of Aggregate Hours Versus Labor Productivity Since Q3 2020

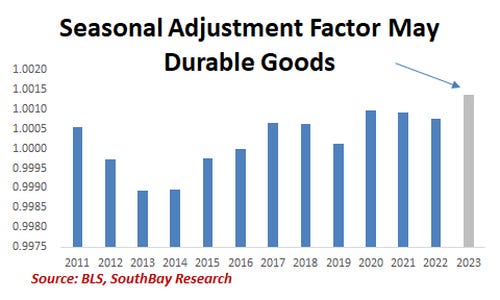

Then again, it is not actually clear as to how strong even the purely labor element is. For one thing, the May seasonal adjustment factors this year look suspiciously large compared to the past 12 years. There is actually no plausible reason for the elevated gray bars shown below—unless someone at the BLS was told to powder the pig.

Here are the May seasonal adjustment charts for eight major sectors of the labor market going back to 2011. Save for these seeming aberrations, the May jobs report would actually have been a dud.

Next, there is also the fact that the BLS publishes two separate jobs reports, which historically have tended to even out over time. But since March 2022 they have not been rising at even remotely the same pace.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.