With each passing month it becomes ever more evident that monetary central planning as practiced by our Keynesian central bankers has come a giant cropper. After twisting the historic notions of sound money and price stability into the economic pretzel known as its 2.00% annual inflation “goal”, the Fed has now proven in spades that it can’t hit the broad side of a barn on this or any other macro-economic target.

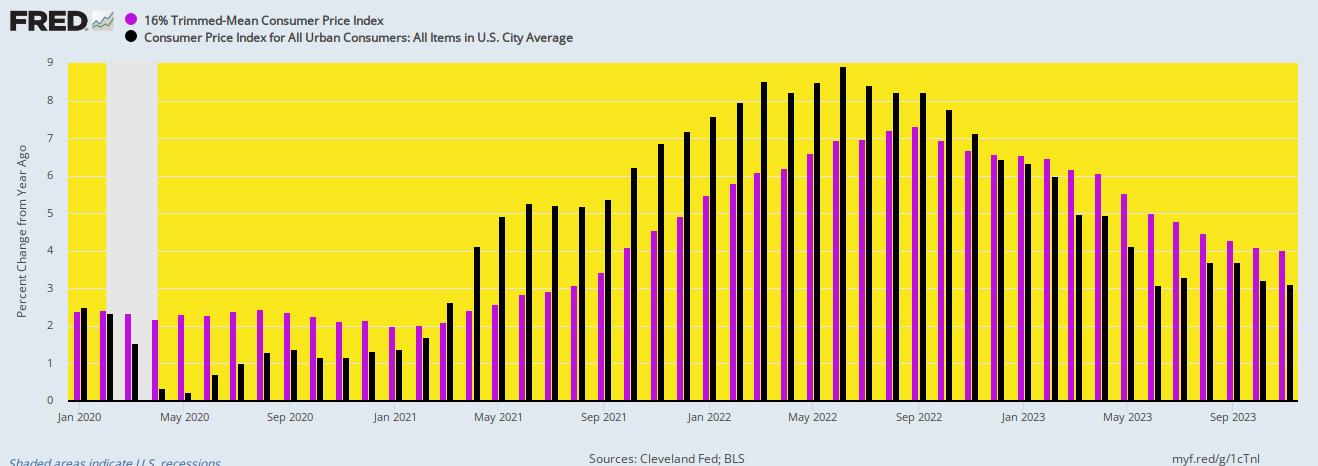

For instance, we are told that the Fed’s is almost there on the inflation front and that the vaunted “soft landing” lies just around the corner. That’s purportedly because the headline CPI (black bars) has made a round trip from a Y/Y rate of 1.0% in late 2020 to a peak of 8.9% in June 2022 and then back to a reading of just 3.1% in the recently reported figures for November.

It sounds like material progress until you recall that even on a 12-month running basis the headline inflation rate is extremely volatile and noise-ridden. The evidence for that is revealed in the monthly chart below, which compares the 16% trimmed mean CPI (purple bars) with the headline CPI.

Since the Covid-lockdown dislocations hit the US economy after February 2020, the smoothed or trimmed mean CPI has cut a much shallower path. It never did dip below the vaunted 2.00% goal, peaked at just 7.3% in September 2020 and clocked in at 4.03% on a Y/Y basis in November 2023.

Needless to say, we don’t think there is much virtue in either 4.0% inflation or even 2.0% inflation. After just one decade, the purchasing power of $1 worth of wages earned today or savings deposited in the bank today would be just 66 cents and 82 cents, respectively.

Y/Y Change In Headline CPI Versus 16% Trimmed Mean CPI, January 2020 to November 2023

The fact is there is no historic basis for the belief that money depreciation at these rates is conducive to maximization of capitalist prosperity, even if these inflation “goals” could be consistently achieved by the central bank. But the real lesson of the Fed’s current quixotic fight against inflation is that it can’t hope to steer the economy consistently along a 2.00% inflation path or, for that matter, along the path of any other macroeconomic goal, even on a mid-term 0r 1-to-2-year basis.

That’s because these variables simply can’t be measured reliably in real time. So if you don’t know where you are now, or have been recently, forecasting and steering toward the near-term future is well-nigh impossible.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.