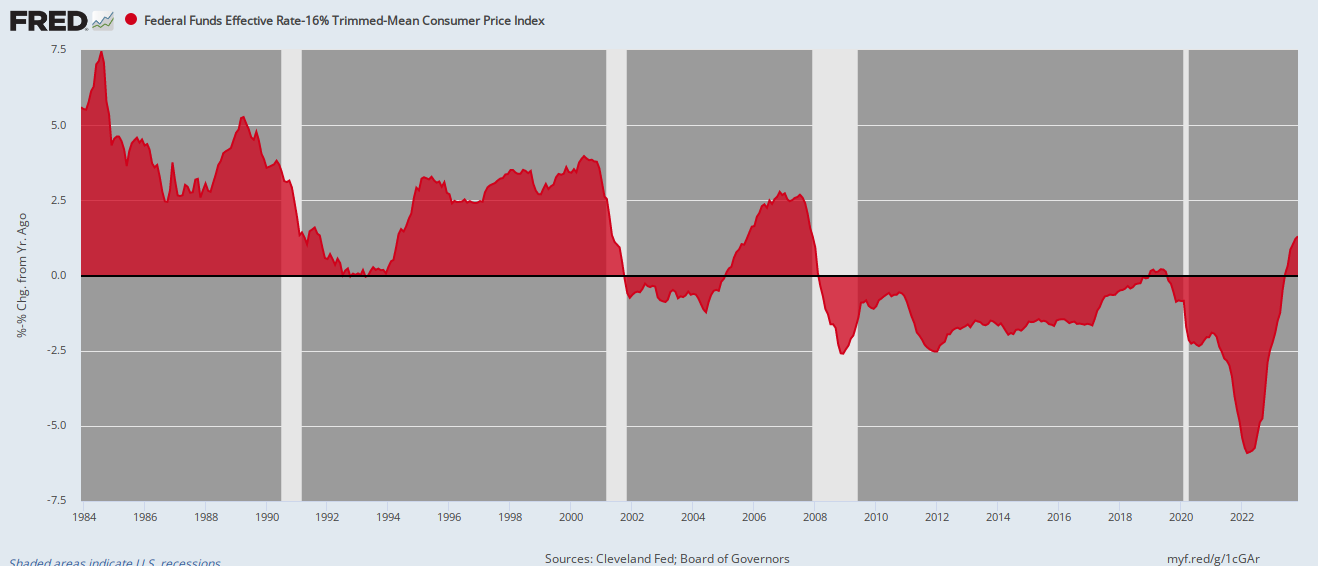

We don’t see any victory over inflation in the chart below—even with its update for the latest November figures. Our trusty 16% trimmed mean CPI still posted at +4.0% Y/Y last month, and aside from the Trumpian-stimmy fueled inflation surge of the last two years, it marked the highest rate of gain since July 1991.

That’s right. We’ve still got the highest trend rate of inflation in 32 years, yet the entitled gamblers and money-shufflers of Wall Street are now literally foaming at the mouth for “rate cuts”. Never mind that at 4% inflation, a dollar held by a wage worker or saver today would be worth just 66 cents a decade from now. The casino just plain needs another round of monetary juice—main street be damned.

Worse still, the Fed is so captive to Wall Street that it is likely to succumb to this pressure within a matter of months. Yet after pumping $8 trillion of fiat credits into the financial markets since September 2008, more rate cuts—which would require another massive round of bond-buying—would literally be an economic and financial abomination.

Y/Y Change In 16% Trimmed Mean CPI, 1991 to 2023

We have no use for the Fed’s idiotic attempts to peg money market rates, obviously. But even in that framework, why in the world would anyone argue for “rate cuts” when the inflation-adjusted Fed funds rate is still at historic lows?

Indeed, the sheer arrogance and greed of Wall Street could not be more evident than in the chart below, which shows the Fed’s pegged funds rate minus the Y/Y inflation rate since 1984. During the 183-month interval between February 2008 and May 2023, the Fed’s core policy tool posted continuously at negative real rates—save for a handful of months in 2019 when the inflation-adjusted funds rate peeked its nose slightly above the zero bound. Yet even with a magnifying glass, it is difficult to spot the latter.

Still, after just six months of tiny positive real rates since May these crybabies are having another tantrum on behalf of rate cuts. In truth, however, under a regime of sound money on the free market, the inflation-adjusted funds rate should be at least +2.0 to +3.0% most of the time, which is still well above current levels.

Inflation-Adjusted Fed Funds Rate, 1984 to 2023

So we are not close to a condition in which rate cuts would be even remotely warranted. In fact, the so-called “progress” on the inflation front stalled-out nine months ago. After peaking at 9.1% in May 2022, the annualized rate of the monthly 16% trimmed mean CPI bottomed at just under 3% in March 2023 and has remained above that level ever since.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.