Joe Biden’s Hideous $106 Billion War Package

What a day for another $106 billion imperial boondoggle. There is not one dime in “Joe Biden’s” war package that enhances the safety and security of the American homeland, yet all of it is being blithely charged to Uncle Sam’s vastly over-extended credit card.

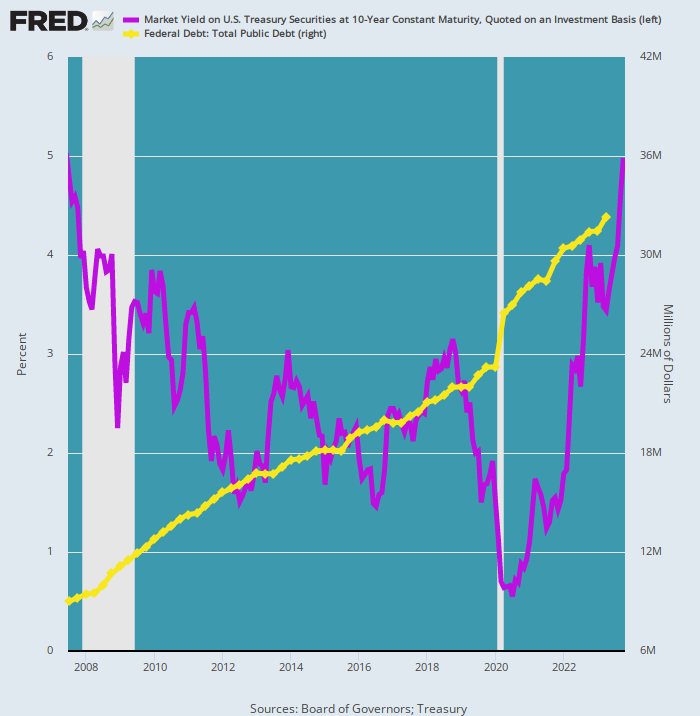

Nor should you take our word for it. What’s left of the Fed-tortured bond market cried out for help this AM, tagging the 5.00% level on the benchmark 10-year UST (purple line) for the first time since June 2007.

But here’s the thing. Back then, the public debt (yellow line) was $8.8 trillion, meaning every 100 basis points of increased yield added $88 billion to annual debt service. Today, of course, the public debt is $33.5 trillion, and the incremental debt service on 100 basis points will amount to $335 billion or nearly 4X more.

Public Debt Versus Yield On 10-Year UST, 2007 to 2023

Unfortunately, 1oo basis points of higher yield isn’t the half of it. As of August 31st, the weighted average yield on the public debt was only 2.92% because during the Fed’s decade long spree of reckless money-printing the US Treasury was able to refi the public debt at absurdly low rates, including at the 0.50% bottom on the 10-year UST in July 2020.

Alas, what comes around goes around. Now the entire yield curve is trading at 5% or above, meaning that all of that ultra-cheap debt will be maturing for years to come, only to be replaced with much higher yields as far as the eye can see. At the moment, the gap between the embedded carry cost of 2.92% and an at-market level of @5.22% would amount to incremental debt service cost of nearly $800 billion per annum!

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.