During the 16-months of pandemic madness from March 2020 thru June 2021 the Uniparty politicians injected $3.075 trillion of extra cash into household bank accounts. A significant part of this huge figure stemmed from the forced savings which happened when Dr. Fauci slapped a “closed” sign on bars, restaurants, gyms, hair salons, movies, malls etc.

In dollar terms this abnormal cash accumulation amounted to $1.157 trillion. It is measured as the reduction in personal consumption expenditures (PCE) for services that occurred during the 16 months of March 2020 to June 2021, when the Lockdown regime was in full force. The services spending reduction is calculated as follows:

Baseline services PCE per the prior 5-year growth rate of 4.41%/year: $14.041 trillion.

Actual services PCE: $12.884 trillion.

16-month reduction from baseline: -$1.157 trillion.

Percent reduction: -8.2%.

At the same time, the eruption of government transfer payments owing to the multiple rounds of stimmies was one for the record books. When Washington threw the “free stuff” spigot wide open, upwards of $1.918 trillion of extra benefits flowed into household banks accounts. Again, the increase for March 2020 to June 2021 is computed as follows:

Baseline government transfer payments per the prior 5-year growth rate of 3.94%/year: $4.316 trillion.

Actual government transfer payments: $6.233 trillion.

16-month increase to baseline: +$1.917 trillion.

Percent increase: +44%.

In combination, the above $3 trillion windfall amounted to hideous overkill. It turns out that during this same 16-month period, aggregate wage and salary income was down by just $573 billion compared to the five-year growth trend prior to February 2020. This negative impact to wage and salary income is computed in a similar manner for the March 2020 to June 2021 period as follows:

Baseline wage & salary income per the 5-year growth rate of 4.68%/year: $13.433 trillion.

Actual wage & salary disbursements: $12.860 trillion.

16-month wage & salary shortfall: -$573 billion.

Shortfall as % of Baseline: –4.3%.

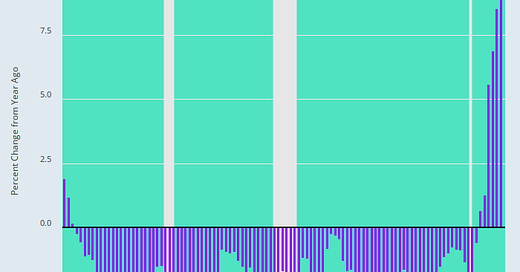

So, yes, the Uniparty geniuses of Washington flooded the US economy with extra cash equal to more than five times the amount of wage and salary income that was actually lost due to the lockdown layoffs and closures. And it was that excess—in the order of $2.5 trillion over and above the lost wage income—that lite the inflationary fires.

Accordingly, there should be no mistake about this history: The ignition of 40-year high inflation happened overwhelmingly on the Donald’s watch.

In Part 2, we demonstrated that upwards of $2.5 trillion of that cash accumulation ended up in bulging household bank accounts as of June 2021 when the lockdown reopenings began. This aberrational cash cushion has been steadily drawn-down since then, and will soon reach zero. But in the meantime, it has acted as a powerful stimulative counterweight to the Fed’s belated attack on inflation.

In the first instance, in fact, this $3 trillion tsunami of household cash triggered a roaring inflation in the global supply chains for merchandise goods. In effect, Washington redirected the bloated spending power of main street households into a frenzy of purchases which could be delivered in safe Amazon boxes to the doorstep of quarantined American consumers.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.