The Fed says it slashed interest rates (Fed funds) by 50 basis points on Wednesday because it judged workers have been punished enough and that wage increases were falling back into line with the dictates of what amounts to America’s financial politburo. And, of course, our paint-by-the-numbers Keynesian knuckleheads could point to charts like the following as proof that their anti-inflation policy has succeeded and that it’s therefore time to get a head start on the next round of rate cuts.

Thus, after accelerating from 2% per annum during 2012-2015 to a peak of nearly 6% by Q2 2022, the Y/Y rate of wage gain has been falling steadily, weighing in at just 3.8% per annum in Q2 2024. So after you layer on some off-setting credit for productivity gains, we suppose the Fed is claiming that unit labor cost growth is heading toward 2.0% per year—a level purportedly compatible with its inflation “goal” of 2.00%.

Stated differently, why wait for the white of their eyes? According to the Eccles Building geniuses, the inflation genie is nearly back in the 2.00% bottle because workers have purportedly capitulated. Or so says the amen chorus of Wall Street speculators and robo-traders.

Y/Y Change In Average Hourly Earnings, 2012 to 2024

Except, not exactly. Here is how Fed policy is actually working and it has damn little to do with wage increase trends.

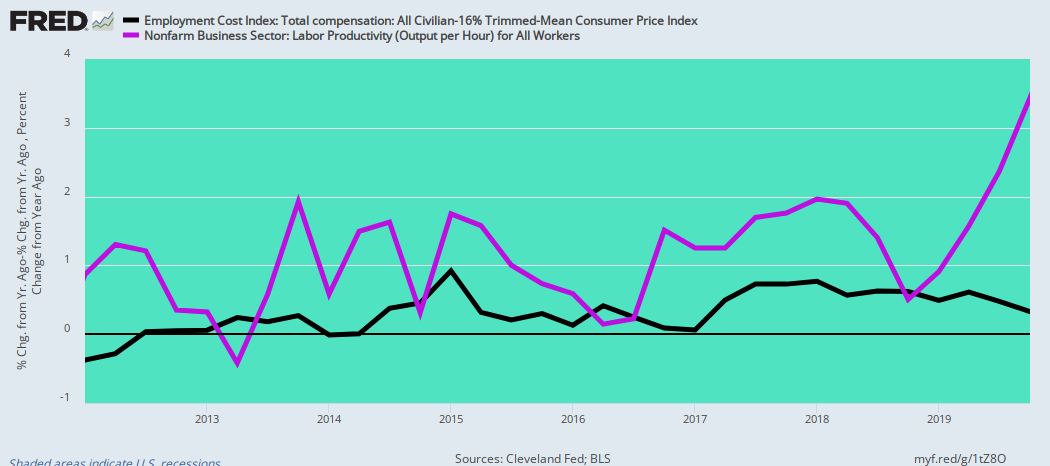

As it happened, the inflation-adjusted cost of worker compensation in the civilian economy had been pretty docile for most of the period after the Fed embraced 2.00% inflation targeting in January 2012. As depicted by the black line in the graph below, real compensation cost growth had averaged only +0.32% per annum through the eve of the pandemic disruption and that was consistently less than the gains in productivity (purple line).

Prior to the pandemic disruption, therefore, there is not a scintilla of evidence that the annual rate of real wage gains were inflating real unit labor costs and therefore pushing headline inflation higher. In fact, the on-going off-shoring of the US industrial economy was keeping real wage growth sharply subdued.

Y/Y Inflation-Adjusted Civilian Compensation Change Versus Productivity Gains, 2012 to 2019

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.