Wall Street had its hair on fire yesterday—apparently on the theory that the battle against inflation has been won and the Fed will soon be turning on the liquidity firehoses by slashing interest rates. So they were backing up the trucks—getting ready for the next upward rip of the Everything Bubble.

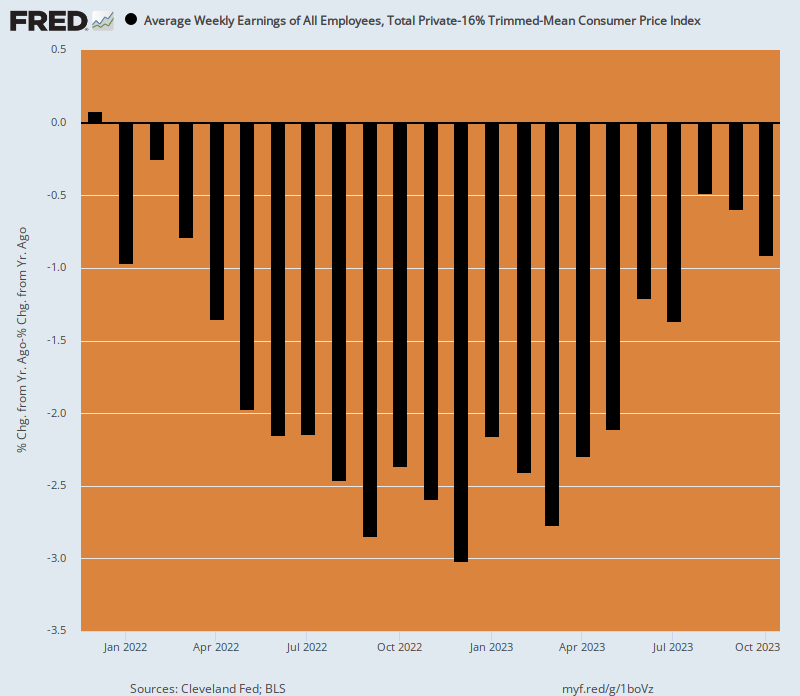

But we’d say, not so fast. As it happened, inflation-adjusted weekly wages declined about 1% on a Y/Y basis in October, marking the 22nd consecutive month of decline. So if that’s winning the inflation battle, it is surely news to main street.

In fact, even during the Great Recession in 2008-2009 there were only 15 months of negative change in real weekly earnings. Moreover, those months weren’t consecutive, and they averaged less than one-third the drop in real terms embedded in the trend depicted below.

So once again, we are witnessing the folly of the Fed’s pro-inflation policies and the misbegotten notion that it should be targeting a 2.0% decline in the purchasing power of money, year-in and year-out. But self-evidently, worker wages have not kept up with the rising price level unleashed by the Fed’s printing presses. It will now take years for workers to catch-up, if ever.

Inflation-Adjusted (Real) Average Weekly Earnings, December 2021 to October 2023

Our monetary politburo, of course, never says it’s sorry or attempts to make amends by running a spell of negative CPI change in order to restore the massive loss of worker purchasing power depicted above. Instead, all this lost ground is supposed to be forgotten about whenever the short-run rate of inflation gets close to the magic 2%.

Indeed, Wall Street would have a screaming hissy fit if the Fed even talked out loud about the possibility of boosting the dollar’s buying power by averaging a period of low or even negative CPI readings with the red-hot numbers of the past two years. And that’s even though on the other side of the barn, when inflation was undershooting its 2% target from below, the Eccles Building advocated for exactly that kind of averaging—a period of above target inflation to “catch-up”.

The fact is, the Wall Street gamblers and money-shufflers are addicted to cheap money and zero-cost carry trades because that’s how they make a handsome living without producing much of real value. So the minute near-term inflation rates can be tortured into something that looks vaguely like victory, the pressure for rate cuts becomes overwhelming.

But why should the central banking branch of the state be in the business of accommodating the greed of financial gamblers if it means perpetuating badly eroded main street wages and savings? And that’s especially the case if it also encourages the sweeping misallocation of capital into speculation and other forms of unproductive malinvestment.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.