Cheap Money Didn’t Cut It

Some big, round-numbered interest rate thresholds have been passed in recent days including 4.0% on the 10-year UST, 5.0% on the 2-year UST and 7.0% on the 30-year mortgage. These all come at the end of extended round trips, of course, so the question at hand is how long did these trips take and what has been accomplished by all of the Fed’s interest rate pegging and repression during the interim.

As to the duration of the round trips, the elapsed time between this week and when rates originally broke lower from current levels are as follows:

Elapsed Time Of Round Trip:

10-Year UST: 5,600 days;

2-Year UST: 5,700 days;

30-Year Fixed Mortgage: 8,090 days.

Let’s start with mortgages, where rates on the 30-year first dipped below 7.0% in February 2001 and then fell steadily for nearly two decades to a low of 2.67% in December 2020. After plateauing for more than a year, the mortgage rate has rocketed back to 7.0% during the last 15 months.

The theory, of course, is that the wise men and woman on the FOMC know far better than the free market the appropriate mortgage rate. And also that, especially, the rate path needed to push higher societal investment in housing should not be left to the happenstance of supply and demand.

Alas, we don’t see much evidence that all the massive interest rate repression summarized above did much for real fixed residential housing investment. As of Q4 2022, the figure was still 36% below its 2005 peak and 15% below the level that pertained before Greenspan really poured gasoline on the housing market after the dotcom crash.

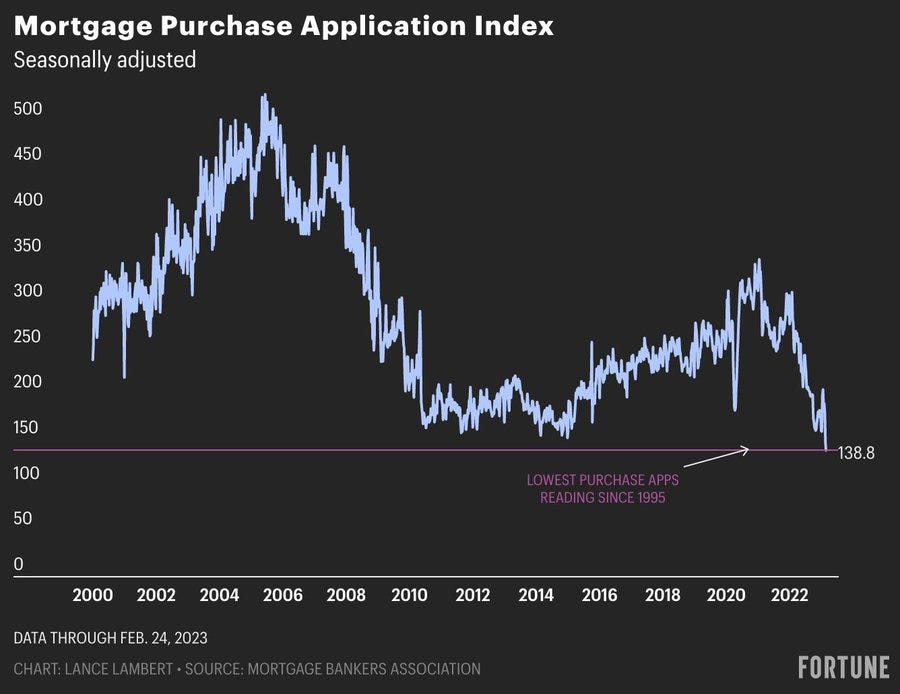

As it happened, the housing investment cycle bottomed in Q3 2010 at about 35% below current levels. Given the rate at which new building activity is now sliding, it would not be surprising at all to see real housing investment approach the post-crisis bottom during the year ahead. After all, the seasonally adjusted Mortgage Purchase Application Index is now at its lowest reading of the 21st century. On a year-over-year basis, total purchase applications are down a staggering 43.7%.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.