When it comes to illuminating the nation’s towering public debt, here are two bookend pictures that are as good as any. In June 1970, when we took leave of protesting the Vietnam War and dodging the draft at Harvard Divinity School in order to pursue the cause of peace and freedom as a Congressional staffer (sic!), the public debt of the United States was $370 billion.

As it happened, our first assignment as a newly minted legislative assistant to Congressman John B. Anderson was to work on the War Powers Act, which was designed to throttle trigger-happy presidents and prevent more Vietnams. Alas, what we got instead was the endless Forever Wars and 53 years later a public debt that stood at $34.0 trillion.

Even in the Washington’s world of giant quantities of OPM (other peoples’ money), a 92-fold rise in anything during a single adult lifetime amounts to a collar-grabber. And, yes, we can take the inflation out of the figure and also put it in context by comparing it to GDP, and the rise of public debt remains no less daunting.

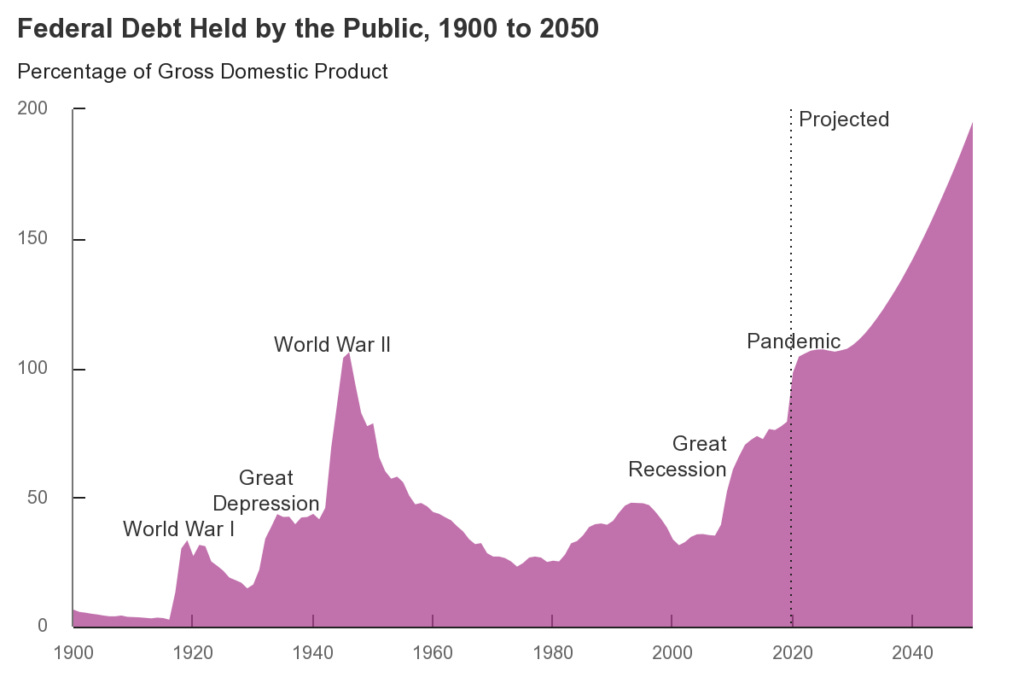

In today’s dollars of purchasing power (2023 $) the public debt in 1970 was $2.3 trillion. So in real terms it grew by 15X over a half century span when the real GDP rose by only 4X. Measured as a burden on national income, therefore, the public debt soared from 35% of GDP and falling in 1970 to 122% of GDP in 2023 and heading steeply skyward.

Our purpose here is to contend that the big picture causes of this unsustainable public debt eruption are War, Welfare and Wampum—and the addiction of the Washington Uniparty to all three. That is, massive, unnecessary spending for national security, a Welfare State entitlements machine that is unchecked by Congress’ power of the purse and a rogue central bank which has enabled both of these spending tidal waves via rampant monetization of the public debt.

These causes are bad enough in their own right. But what is worse is the conventional wisdom holding that all this government spending, borrowing and printing had a silver lining. Allegedly, it enabled Washington to counteract recessions and stimulate higher economic and jobs growth during that 53-year span than would have otherwise occurred under market capitalism left to its own devices.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.