Another Debt Ceiling Crisis, Another Deficit Reduction Scam

Today’s stock market action was still another reminder that honest price discovery on Wall Street is deader than a doornail.

Apparently, as a result of some friendly-sounding PR gas-bagging this AM from both sides of the debt ceiling stand-off, the market rallied hard in the morning and stayed pinned at that level for the balance of the session.

Dow jumps 400 points as traders bet on a debt ceiling deal being reached

Yes, and if dogs could whistle, the world would be a chorus!

That is to say, we seriously doubt that there will be any signed deal before the so-called X-date of June 1. And if some Rube Goldberg device is patched together at the 11th hour, it will make hardly an iota of difference to the nation’s disastrous fiscal outlook.

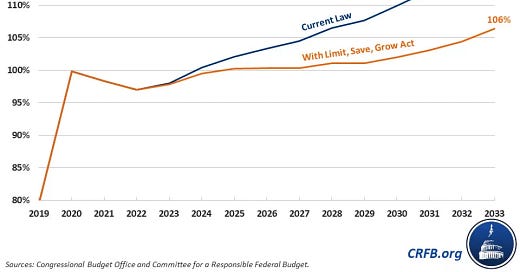

Indeed, here’s a spoiler alert version of what is coming down the pike. With or without a deal, the Federal debt-to-GDP ratio is heading for record peacetime levels. And the alternate pathways shown in the graph below assume there will never again be another recession, war, Covid-type national emergency or any other deviation from CBO’s picture perfect projection of economic performance and Congressional adherence to the massive tax increases and outyear spending cuts already built into current law and the CBO baseline forecast.

The actual truth is that the current policy baseline already generates $20 trillion of new Federal debt over the 10-year budget window (FY 2024-2033). But that figure would be $25 trillion at minimum when adjusted for realistic economics and the virtual certainty that currently scheduled out-year tax increases and spending cuts will be cancelled at the last minute, like they always are.

In turn, that means the public debt will hit a minimum of $55 trillion by 2033 or nearly 150% of GDP.

As to the chart below, forget the House GOP’s yellow line. The overwhelming share of that is pure fakery and would never happen in the real world over the next decade, even if the Dems were to pitch the GOP a temporary fiscal mulligan on May 31st.

And when you set aside or sharply dilute the solid components of the GOP plan—the $1.0 trillion of savings from cancelling Sleepy Joe’s student debt cancellation plan and the green energy tax credits embodied in the so-called Inflation Reduction Act—there is precious little left, as we amplify below.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.