America’s Stagflationary Mess—The Bastard Son Of MAGA, Part 1

There can be no doubt that the US economy is struggling with a serious bout of stagflation, and that’s notwithstanding the foul ball GDP print for Q3 2023. Fully half of the reported 4.9% annualized real GDP gain was due to a huge inventory build-up (+1.32%), health care (+0.33%) and government spending (+0.79%). We’d suggest these items are neither stable from quarter to quarter nor the ingredients of what actually fuels rising living standards and societal wealth.

In fact, during the last six quarters the print for real GDP minus these three volatile/dubious items has averaged only 1.80% per annum. Relative to historic growth of 3-4% per annum during the heyday of American prosperity, the recent “core” GDP trend representing fixed investment, domestic consumption and net exports has been nothing to write home about.

Annualized Real GDP Change Excluding Inventories, Government Spending And Health Care:

Q2 2022: +1.79%.

Q3 2022: +2.36%.

Q4 2022: +0.31%.

Q1 2023: +2.56%.

Q2 2023: +1.26%.

Q3 2023: +2.46%.

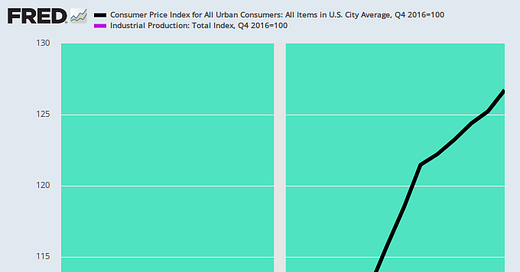

There can also be no doubt that all roads lead back to Donald Trump’s disastrous economic stewardship during 2017 through 2020. Since Q4 2016 the price level (CPI) has risen by 27% owing to the massive monetary and fiscal stimmies the Donald superintended, while actual output as measured by the industrial production index, (manufacturing, energy and mining and utilities) has gained only 4.6%.

The latter figure computes to an annual rate of just 0.67% per annum, which is only one-fifth of the 3.0% per annum rate which prevailed over the 69-year span between 1949 and 2016.

So, yes, since the Donald ambled into the Washington Swamp, and also paved the way for the equally destructive depredations of Sleepy Joe Biden, main street growth has slid into the ditch, even as the dollar has lost more than one-quarter of its purchasing power.

That’s screaming stagflation by any other definition.

Index Of Industrial Production Versus CPI, Q4 2016 to Q3 2023

Moreover, this stagflationary outcome is hardly the half of it. The fact is, the four-year span of the Donald’s term (2016-2020) encompassed the final years of the post-Great Recession recovery. Even by the lights of milquetoast Republicanism it was therefore supposed to be a time in which monetary and fiscal policy would be resolutely normalized.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.