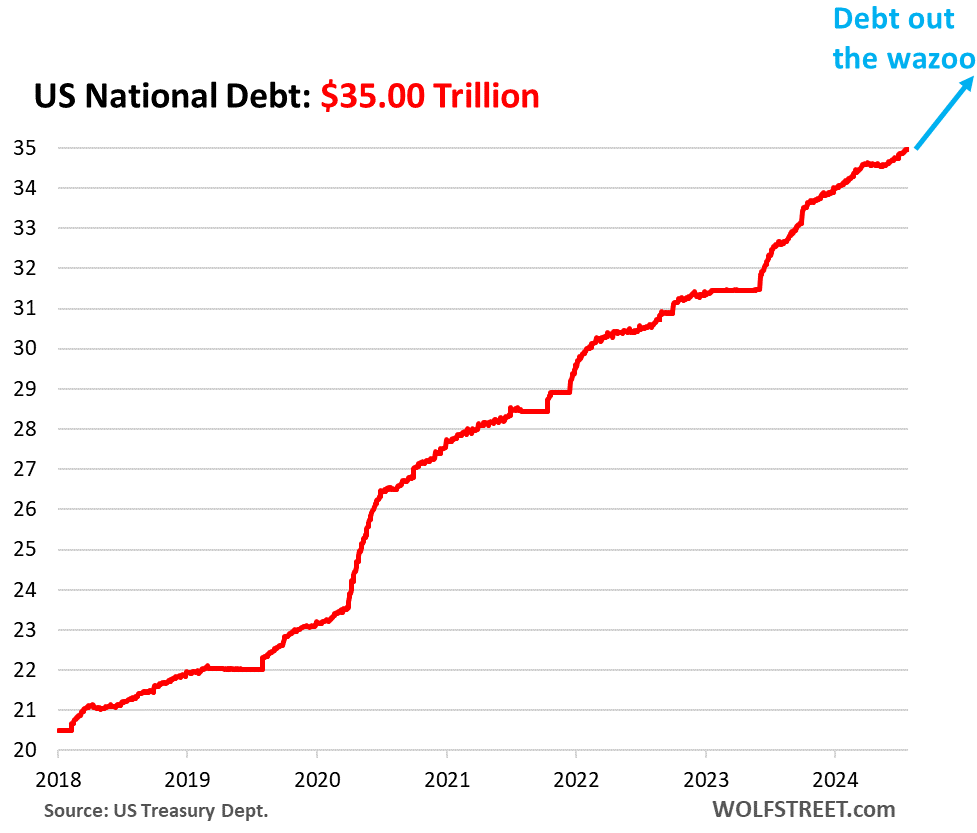

During the past week the mainstream media gummed endlessly about JD Vance’s sarcastic riff on childless cat-women, but nary a one noted that America just crossed the $35 trillion public debt mark. What is worse, this ignoble crossing represented a $1 trillion gain just since January, and also a 75% rise from the $19.9 trillion level extant when the Trump-Biden “borrow and spend” twins entered the Oval Office in January 2017.

That’s right. We are now being governed by a UniParty consensus that basically says the debt be damned. The Donald borrowed $8 trillion during his four years—more than the first 43 president combined during the first 216 years of the Republic; and now, having already borrowed an additional $7 trillion, the “Joe Biden” entity is apparently racing to best the Donald’s disgraceful performance before they wheel him/it out of the Oval Office on next January 20th.

The plain fact is that Washington is on a fiscal trajectory that can only result in financial catastrophe, and not all that far down the road, either. The current perverse UniParty policy consensus firmly blocks all other routes forward:

The Dems have turned the very idea of entitlement cuts from what will be the $30 trillion cost of Social Security/Medicare/Medicare/Federal retirement over the next decade into the third rail of American politics.

Likewise, the GOP stands like junk yard dogs in the way of any and all taxes increases, including insistence on extending at a 10-year cost of $4 trillion the expiring Trump tax cuts.

The warmongers and neocons of both wings of the UniParty drive the hideously bloated $1.3 trillion per year Warfare State budget endlessly higher.

And now the monetary facts of life are causing the normalization of interest rates and a veritable explosion of Federal interest expense, which is rocketing from $300 billion annually a few years back to $3 trillion per annum or higher just around the corner.

As it happens, we have been tracking the public debt number for what amounts to a lifetime. This journey commenced exactly 54 years ago when we were asked for a report on the national debt by our new boss, Congressman John Anderson, who was a solid fiscal conservative from Illinois. We informed him that the public debt was growing at an”alarming” rate and would soon reach, wait for it, $400 billion!

That means this week’s big round figure is 95 times greater. Nor can this staggering rise be dismissed on the grounds that the US economy grew commensurately in the interim.

It didn’t. Not remotely. During the same 54 year period, nominal GDP has risen by only 27 times. So what has actually shot the moon is the Federal debt ratio (black line), which has soared from 34% of GDP and falling back then, to 122% of GDP and heading rapidly skyward today.

Keep reading with a 7-day free trial

Subscribe to David Stockmans Contra Corner to keep reading this post and get 7 days of free access to the full post archives.